Understanding Risk Tolerance in Investing: Making Smart Choices for Long-Term Growth

Understanding Risk Tolerance in Investing: Making Smart Choices for Long-Term Growth

Embarking on the investment journey can be both exciting and daunting. At its core, successful investing hinges on understanding risk tolerance in investing—a personal measure of how much financial risk you're willing and able to take on to pursue your financial goals. It's not just about chasing high returns; it's about making smart choices that align with your comfort level and long-term objectives. Ignoring your true risk tolerance can lead to stress, poor decisions during market volatility, and ultimately, hinder your journey toward long-term growth. This guide will help you define your risk comfort zone and build a resilient investment strategy.

Key Points:

- Personalized Approach: Risk tolerance is unique to each investor and dictates suitable investment choices.

- Balance Risk & Reward: High potential returns often come with higher risk; finding your balance is essential.

- Long-Term Strategy: Aligns your portfolio with your financial goals, avoiding impulsive reactions.

- Factors Influence: Age, income, financial goals, and personal experiences all shape your risk profile.

- Regular Review: Your risk tolerance can evolve; periodic assessment is crucial for sustained success.

What is Investment Risk Tolerance and Why Does it Matter for Your Portfolio?

Investment risk tolerance refers to an individual's capacity and willingness to endure fluctuations in the value of their investments. It's a critical component of financial planning, acting as the bedrock upon which all investment decisions should be built. Without a clear understanding of your own risk tolerance, you might find yourself in an investment portfolio that either keeps you up at night or leaves potential growth on the table.

For instance, someone with a high risk tolerance might be comfortable investing heavily in volatile assets like growth stocks or emerging markets. These assets carry greater potential for significant gains, but also substantial losses. Conversely, an investor with a low risk tolerance would likely prefer safer, more stable investments such as bonds or established blue-chip companies, prioritizing capital preservation over aggressive growth. Your risk tolerance directly influences your asset allocation and the specific types of securities you hold, making it fundamental for making smart choices towards long-term growth.

Assessing Your Investment Risk Tolerance: A Comprehensive Approach

Accurately assessing your investment risk tolerance involves more than just a quick questionnaire. It requires a thoughtful evaluation of several interconnected factors: your financial capacity, your psychological comfort, and your specific financial goals. Overlooking any of these elements can lead to a misaligned strategy that may cause distress during market downturns or fail to generate adequate returns. A truly comprehensive assessment considers both your ability to take risks and your willingness to do so.

Factors Influencing Your Risk Profile

Several key elements come into play when determining your unique risk profile.

- Financial Situation: Your income stability, existing debt, emergency fund, and net worth significantly impact your ability to absorb potential investment losses. A strong financial foundation generally allows for greater risk-taking.

- Investment Horizon: This refers to the length of time you plan to keep your money invested. Generally, a longer time horizon (e.g., for retirement savings) allows you to ride out market fluctuations and take on more risk, as there's more time for recovery.

- Financial Goals: Are you saving for a down payment in two years or retirement in thirty? Short-term goals typically necessitate lower-risk investments, while long-term goals can accommodate higher risk for greater potential returns.

- Personal Experience: Past experiences, both positive and negative, profoundly shape an investor's psychological disposition towards risk. Significant losses in the past can understandably make one more risk-averse.

Differentiating Capacity from Willingness

It's crucial to distinguish between risk capacity and risk willingness. Risk capacity is your objective ability to take risks without jeopardizing your financial well-being. This is largely determined by your financial situation and investment horizon. Risk willingness, on the other hand, is your subjective comfort level with potential losses. Some individuals might have a high capacity but a low willingness, preferring peace of mind over potential higher returns. A truly optimized portfolio balances both.

Navigating Psychological Biases and Market Volatility

Even with a clear understanding of your risk tolerance, psychological biases can derail the best investment plans. Behavioral economics teaches us that emotions often cloud judgment, especially during market volatility. Differentiated from conventional advice, it's vital to actively acknowledge and counteract these inherent human tendencies. For instance, loss aversion, identified by Nobel laureate Daniel Kahneman, suggests that the pain of losing is psychologically twice as powerful as the pleasure of gaining. This often leads investors to sell assets during a downturn, locking in losses, rather than holding on for recovery, a common mistake cited in investor behavior studies from 2024 by leading financial institutions.

Another significant bias is herd mentality, where investors follow the crowd, buying into assets when prices are high (fear of missing out) and selling when prices are low (panic). To combat this, adhere strictly to your pre-defined investment plan based on your risk tolerance. Regularly reviewing your financial goals and portfolio performance helps maintain perspective, preventing emotional reactions to short-term market noise. As a 2023 report by the Financial Planning Association noted, disciplined investors who stick to their long-term strategy significantly outperform those who react impulsively to market swings.

Building Investment Strategies Aligned with Your Risk Tolerance

Once you have a clear picture of your risk tolerance, you can begin constructing an investment portfolio that truly aligns with your comfort level and objectives. This involves strategic asset allocation, thoughtful diversification, and understanding various investment vehicles.

Conservative Investment Strategies (Low Risk Tolerance)

Investors with a low risk tolerance prioritize capital preservation and stable, albeit modest, returns.

- Focus on Income-Generating Assets: High-quality bonds, dividend-paying stocks, money market funds, and Certificates of Deposit (CDs).

- Diversification: While still crucial, diversification here focuses on reducing volatility within safer asset classes.

- Emergency Fund: Maintain a robust emergency fund to avoid liquidating investments during unexpected events. For more insights on managing your personal finances and improving your credit, visit our Credit Score Improvement category.

Moderate Investment Strategies (Medium Risk Tolerance)

These investors seek a balance between growth and stability, willing to accept some fluctuation for better returns.

- Balanced Portfolio: A mix of equities (stocks) and fixed-income assets (bonds), often split 60/40 or 50/50, depending on the individual.

- Growth and Value Stocks: Incorporate a blend of established companies with growth potential and stable, undervalued firms.

- Diversified Funds: Utilize exchange-traded funds (ETFs) and mutual funds across different sectors and geographies to spread risk.

Aggressive Investment Strategies (High Risk Tolerance)

Aggressive investors are comfortable with significant market fluctuations in pursuit of substantial long-term gains.

- Equity-Heavy Portfolio: A large percentage of assets (70-100%) in stocks, including growth stocks, small-cap companies, and international equities.

- High-Growth Sectors: Investments in emerging technologies, biotechnology, or other sectors with high potential but also high volatility.

- Careful Due Diligence: Even with high tolerance, thorough research is paramount to avoid speculative traps. Building a resilient portfolio is key; read more in our guide on Building a Resilient Investment Portfolio: Key Strategies.

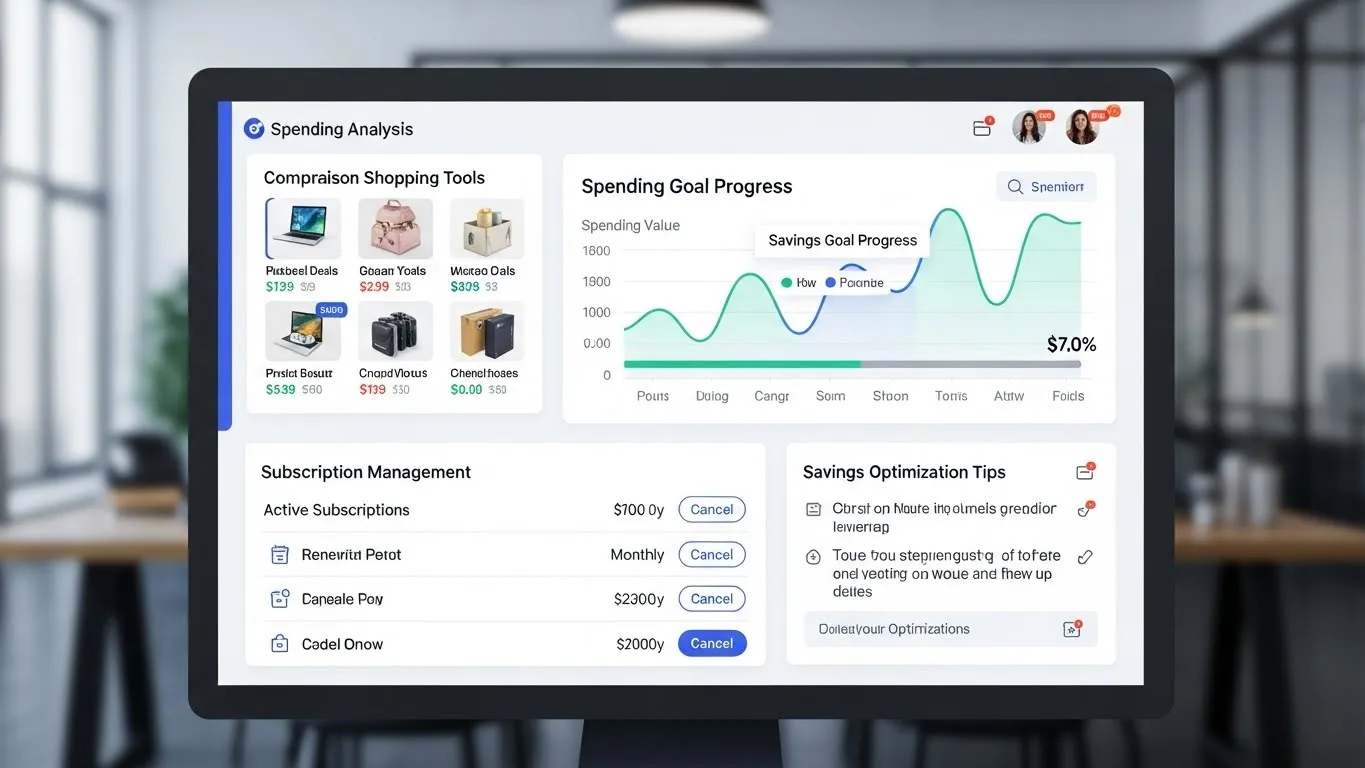

The Role of Technology and Timely Reviews in Risk Assessment

The landscape of personal finance is ever-evolving, with new technologies offering sophisticated tools for risk assessment. Modern financial planning platforms often incorporate AI-driven analytics to provide more personalized risk profiles, moving beyond simple questionnaires. These tools can analyze spending habits, debt levels, and even behavioral patterns to offer a more nuanced understanding of an individual's true financial comfort zone. Keeping abreast of these innovations can provide a significant advantage in refining your investment strategy for long-term growth.

It's also essential to acknowledge that your risk tolerance isn't static. Major life events—such as marriage, having children, buying a house, career changes, or approaching retirement—can significantly alter your financial capacity and willingness to take risks. Therefore, a timely review of your risk tolerance and investment strategy is crucial, ideally on an annual basis or after any significant life change. A strong credit score, for instance, can enhance your financial stability and indirectly influence your investment options; explore more about How a Strong Credit Score Can Enhance Your Investment Opportunities.

Frequently Asked Questions (FAQ)

What if my risk tolerance changes over time?

Your risk tolerance is not fixed. Major life events, changes in income, or nearing retirement can all alter your capacity and willingness to take risks. It's crucial to reassess your risk tolerance at least annually or after any significant life changes to ensure your investment portfolio remains aligned with your comfort level and financial goals.

Is a high risk tolerance always better for investing?

Not necessarily. While a higher risk tolerance can open the door to investments with greater potential returns, it also exposes you to larger potential losses. The "best" risk tolerance is the one that allows you to remain comfortable and disciplined during market fluctuations, preventing emotional decisions that could harm your long-term growth.

How can I determine my risk capacity versus my risk willingness?

Risk capacity is your objective financial ability to take risks (based on income, savings, time horizon). Risk willingness is your subjective psychological comfort with potential losses. Financial advisors often use detailed questionnaires and discuss your life situation to help you understand both, ensuring your portfolio aligns with both your financial reality and emotional comfort.

Can investment tools help me understand my risk tolerance better?

Yes, many online platforms and financial advisors use sophisticated tools, including questionnaires and scenario analyses, to help assess your risk tolerance. Some advanced tools even incorporate behavioral finance principles to identify potential biases that might influence your perception of risk, providing a more accurate profile for understanding risk tolerance in investing.

Conclusion: Empowering Your Investment Journey for Long-Term Growth

Understanding risk tolerance in investing is not just a theoretical exercise; it's a fundamental step toward building a successful and sustainable financial future. By accurately assessing your capacity and willingness to take risks, you empower yourself to make smart choices that resonate with your personal financial journey. This personalized approach prevents knee-jerk reactions to market volatility and sets a clear path for achieving your long-term growth objectives. Remember, the goal is not to eliminate risk, but to manage it wisely and strategically.

Ready to take control of your financial destiny? Start by evaluating your current investment portfolio against your true risk tolerance. Consider consulting a financial advisor for personalized guidance. Share your thoughts or questions in the comments below, or subscribe to our newsletter for more expert insights into smart investing and financial planning! For more in-depth information, explore our articles on portfolio diversification and strategic financial planning.

Publication Date: December 2, 2025. This article provides general information and recommendations based on current financial best practices. Market conditions and investment advice evolve; we recommend reviewing your strategy regularly. Update Frequency Recommendation: Annually, or after any significant personal financial changes. Expandable Subtopics:

- The Impact of Inflation on Risk Tolerance and Investment Returns.

- Behavioral Finance: Deep Dive into Cognitive Biases Affecting Investment Decisions.

- Utilizing Robo-Advisors for Risk-Aligned Portfolio Management.