Overcoming Obstacles to Financial Freedom: Common Challenges and Solutions

Overcoming Obstacles to Financial Freedom: Common Challenges and Solutions

Achieving financial freedom is a deeply personal yet universally desired goal. It represents the ability to live life on your own terms, free from the constant stress of financial worry. This article, published on December 13, 2025, aims to illuminate the common obstacles that stand between individuals and their pursuit of financial independence, providing actionable strategies and innovative solutions to navigate these challenges successfully. Understanding these hurdles is the first step toward crafting a resilient financial plan and building a future where your money works for you, not the other way around. By identifying the root causes of financial stagnation and embracing strategic changes, you can begin your journey toward a life of greater security and choice.

Key Points:

- Debt Management: Strategies to eliminate high-interest debt effectively.

- Budgeting & Planning: The importance of a clear financial roadmap.

- Automated Savings: Leveraging technology for consistent wealth growth.

- Behavioral Finance: Addressing psychological barriers to financial success.

- Diversified Income: Exploring new avenues for increased cash flow.

Understanding the Road to Financial Freedom

The path to financial freedom isn't a single, straightforward highway; it's often a winding road with various detours and potential roadblocks. It’s about more than just having a lot of money; it's about having enough resources to cover your living expenses for the rest of your life without having to work if you choose not to. This state of financial independence allows for greater autonomy, reduces stress, and opens up opportunities for pursuing passions. However, many find themselves struggling to gain traction, facing a myriad of challenges that seem insurmountable. Recognizing these common obstacles is crucial for developing effective strategies to overcome them and stay on track.

Common Obstacles to Achieving Financial Freedom

Many factors can impede your progress toward financial freedom, ranging from external economic pressures to internal behavioral patterns. Identifying these specific hurdles is key to developing targeted solutions. Understanding the landscape of common financial pitfalls allows you to anticipate and prepare for them proactively, turning potential setbacks into opportunities for growth.

The Debt Trap: Overcoming Consumer & High-Interest Debt

One of the most pervasive obstacles to financial freedom is high-interest debt, particularly from credit cards and personal loans. The compounding interest can make it feel like you're running on a treadmill, making payments but never truly reducing the principal balance. This cycle drains your income, leaving less for savings and investments, and significantly extends the timeline to achieve financial independence. Many struggle with consolidating these debts or even knowing where to start.

Lack of a Clear Financial Plan and Budgeting

Without a clear financial plan, you're essentially navigating without a map. Many individuals operate day-to-day, making spending decisions without a comprehensive understanding of their income, expenses, and long-term goals. A lack of a realistic budget means money often disappears without accountability, making it impossible to identify areas for saving or to direct funds toward wealth-building activities. This absence of direction can lead to missed opportunities for growth.

Insufficient Savings and Emergency Funds

A significant number of households struggle with inadequate savings, especially when it comes to an emergency fund. Unexpected expenses, such as medical emergencies, car repairs, or job loss, can quickly derail even the most modest financial progress if there isn't a safety net. Without a robust emergency fund, individuals are often forced to resort to high-interest debt, perpetuating the debt cycle and hindering their journey toward financial freedom. To learn more about building a robust emergency fund, explore effective strategies and tips. /articles/how-to-build-a-robust-emergency-fund-strategies-and-tips

Behavioral Biases and Financial Psychology

Beyond practical challenges, our own psychology plays a significant role in our financial decisions. Behavioral biases, such as present bias (preferring immediate gratification over future rewards) or loss aversion (fear of losing money outweighs the desire to gain), can lead to suboptimal choices. Procrastination in saving, impulsive spending, and emotional investing are common manifestations. Recognizing these ingrained patterns is a vital, yet often overlooked, step toward making more rational and beneficial financial choices. This deeper understanding of self is a crucial differentiated insight for sustained financial success.

Market Volatility and Investment Fears

The unpredictable nature of financial markets can be a major source of anxiety, deterring many from investing. Fears of losing money, especially during market downturns, can lead to paralysis or making rash decisions, such as selling investments at a loss. This apprehension prevents individuals from harnessing the power of compounding and long-term market growth, which are fundamental to building substantial wealth. Understanding investment risks /articles/understanding-and-managing-investment-risks-for-long-term-growth is key to navigating these fears.

Actionable Solutions for Building Financial Independence

Overcoming these obstacles requires a combination of discipline, strategic planning, and leveraging available tools. The good news is that for every challenge, there's a practical, actionable solution designed to move you closer to your financial goals.

Strategizing Debt Elimination: From Avalanche to Snowball

To tackle debt, start by listing all your debts, including interest rates and minimum payments. The debt avalanche method prioritizes paying off debts with the highest interest rates first, saving you the most money over time. Alternatively, the debt snowball method focuses on paying off the smallest balance first, providing psychological wins that can keep you motivated. Whichever method you choose, consistency is key to freeing up cash flow for savings and investments.

Mastering Your Budget and Financial Planning

Creating a detailed budget is non-negotiable. Use apps, spreadsheets, or even pen and paper to track every dollar in and out. The 50/30/20 rule (50% for needs, 30% for wants, 20% for savings and debt repayment) is a great starting point. Beyond budgeting, develop a comprehensive financial plan that outlines your short-term and long-term goals, whether it's buying a house, funding retirement, or starting a business. Regularly review and adjust your plan to ensure it remains aligned with your evolving life circumstances.

Automating Savings and Investments

One of the most effective ways to ensure consistent progress is to automate your savings and investments. Set up automatic transfers from your checking account to your savings, investment accounts, or retirement funds immediately after payday. This "pay yourself first" strategy ensures that money is allocated to your financial future before you have a chance to spend it. This approach is a cornerstone of the Savings and Investment Automation category, making wealth building effortless. /categories/savings-and-investment-automation

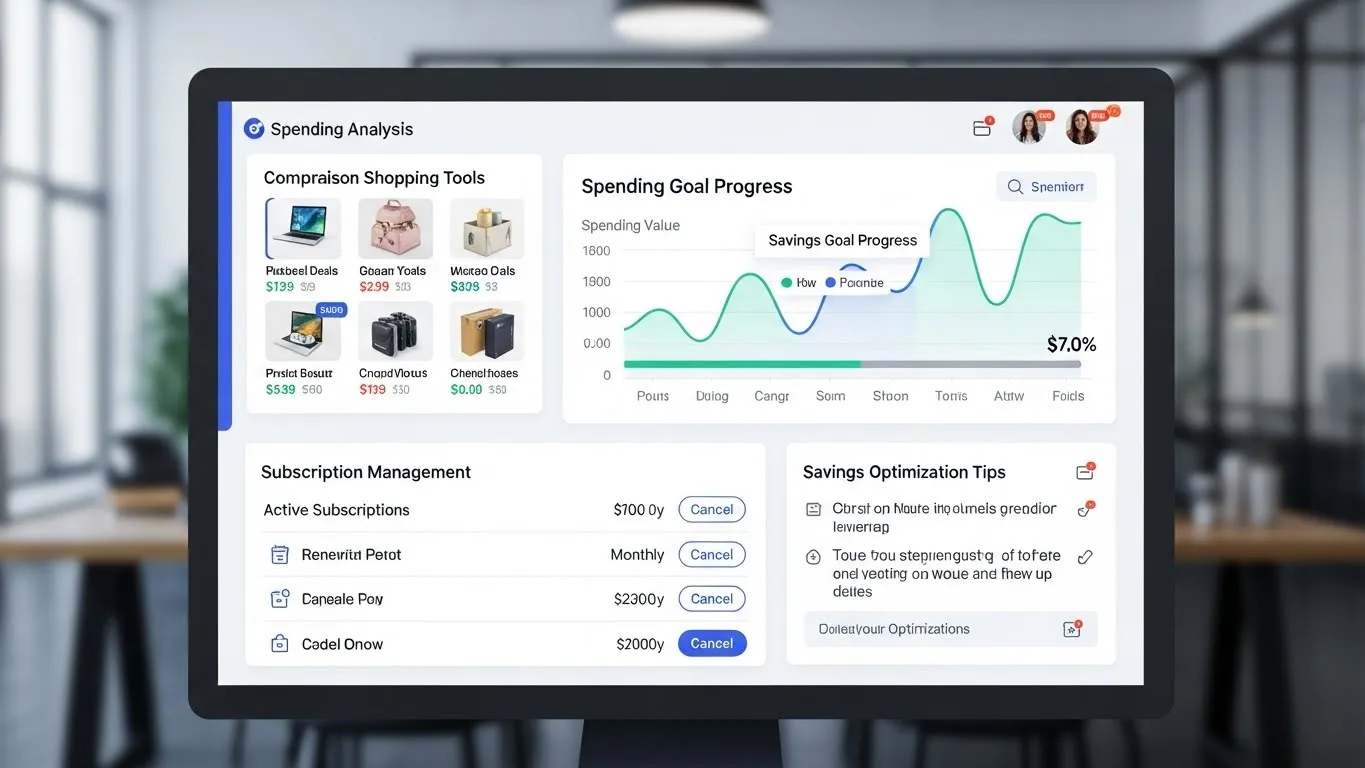

Harnessing Technology: AI in Personal Finance

The latest industry trends show a significant rise in AI-driven financial planning tools and apps. These platforms can analyze your spending patterns, suggest personalized savings goals, optimize investment portfolios, and even identify opportunities for cost reduction. For example, a 2025 Deloitte report on "The Future of AI in Personal Finance" highlighted how AI-powered platforms are making sophisticated financial advice accessible to a wider audience, offering hyper-personalized guidance that adapts to real-time financial changes. Embracing these technological advancements can provide a significant edge in managing your money more efficiently and effectively.

Diversifying Income Streams and Skill-Building

Relying on a single income source can be precarious. Explore opportunities to diversify your income, whether through a side hustle, freelance work, or investing in income-generating assets. Consider developing new skills that are in demand, which can lead to higher earning potential or open doors to new career paths. A 2024 Federal Reserve report on household economic well-being noted that households with diversified income sources demonstrated greater financial resilience during economic fluctuations.

Seeking Professional Financial Guidance

Sometimes, the best solution is to seek advice from an expert. A certified financial planner can help you assess your current situation, create a tailored plan, and guide you through complex financial decisions. They can provide unbiased advice, help you stay accountable, and ensure your strategies are aligned with your long-term goals.

Long-Term Strategies for Sustainable Wealth Building

Achieving financial freedom is an ongoing process, not a destination. Sustaining it requires continuous effort and adaptation.

Regular Portfolio Review and Rebalancing

Your investment portfolio needs periodic attention. Market conditions change, and your financial goals may evolve. Regularly review your portfolio, at least once a year, to ensure your asset allocation still matches your risk tolerance and objectives. Rebalancing involves selling off investments that have performed exceptionally well and buying more of those that have underperformed, bringing your portfolio back to its target allocation.

Continuous Financial Education

The financial landscape is always changing. Commit to continuous learning about personal finance, investing, and economic trends. Read reputable financial publications, listen to podcasts, and attend webinars. The more knowledgeable you are, the better equipped you'll be to make informed decisions and adapt to new challenges and opportunities.

Frequently Asked Questions

Q: How quickly can I achieve financial freedom?

A: The timeline for achieving financial freedom varies greatly depending on individual circumstances, including income, expenses, debt levels, and investment strategies. While some may reach it in 10-15 years through aggressive savings and investing, for others, it might be a 20-30 year journey. Starting early, minimizing debt, and consistently investing are key accelerators.

Q: Is it possible to achieve financial freedom on a modest income?

A: Yes, it is absolutely possible. While a higher income can accelerate the process, consistent saving, smart budgeting, debt management, and investing are more crucial than the absolute income amount. Focusing on increasing your savings rate, even by a small percentage, and leveraging the power of compound interest over time can lead to significant wealth accumulation.

Q: What's the most important first step towards financial freedom?

A: The most important first step is creating a clear, realistic budget and tracking your spending. This allows you to understand where your money is going, identify areas for reduction, and allocate funds more effectively towards debt repayment, savings, and investments. Without this foundational understanding, making meaningful progress can be challenging.

Your Journey to Financial Empowerment Starts Now

Overcoming the common obstacles to financial freedom is a journey that requires commitment, strategy, and perseverance. By actively managing debt, embracing smart budgeting, automating your savings and investments, understanding your financial psychology, and leveraging modern financial technologies, you can systematically dismantle barriers to your wealth-building goals. Remember that every small step forward contributes to significant progress over time.

Don't let these challenges define your financial future. Take control today! Share your biggest financial hurdle in the comments below, or subscribe to our newsletter for more insights into achieving lasting financial independence. For further reading, explore articles on advanced investment strategies and optimizing your automated savings plans.