Mapping Your Path to Financial Freedom: Key Milestones and Strategies for Sustainable Independence

Mapping Your Path to Financial Freedom: Key Milestones and Strategies for Sustainable Independence

Embarking on the journey to financial freedom is a transformative experience, offering liberation from financial stress and the opportunity to live life on your own terms. It's not merely about accumulating wealth; it's about building a robust financial ecosystem that supports your life goals, provides security, and ensures sustainable independence. This comprehensive guide will help you in mapping your path to financial freedom, outlining essential milestones and actionable strategies to help you navigate this rewarding journey. By understanding the core principles and implementing proven techniques, you can systematically work towards a future where your money works for you, not the other way around.

Key Points for Sustainable Independence:

- Define Your Vision: Clearly articulate what financial freedom means to you.

- Master Your Finances: Establish a strong foundation through budgeting and debt elimination.

- Invest Systematically: Leverage compound interest with diversified investment strategies.

- Diversify Income: Explore passive income streams and income optimization.

- Prioritize Financial Education: Continuously learn and adapt your strategies.

Understanding the Foundation of Sustainable Independence

Achieving sustainable financial independence begins with a clear understanding of your current financial situation and a compelling vision for your future. This initial phase involves more than just numbers; it requires a mindset shift towards intentional living and proactive financial management. Before you can begin mapping your path to financial freedom, you must first chart your current position and identify your desired destination.

What Does Financial Freedom Truly Mean?

For many, financial freedom isn't just about being rich; it's about having enough passive income to cover your living expenses without needing to work a traditional job. It’s the ultimate goal of sustainable independence, offering control over your time, energy, and life choices. This might mean different things to different people – from having a significant emergency fund to full early retirement. The key is to define your personal version of financial freedom and set concrete goals around it.

Essential First Steps: Building Your Financial Bedrock

Before scaling the heights of wealth, you need a solid foundation. This involves crucial steps like creating a budget, managing debt, and establishing an emergency fund. These actions are foundational to any effective wealth building strategy.

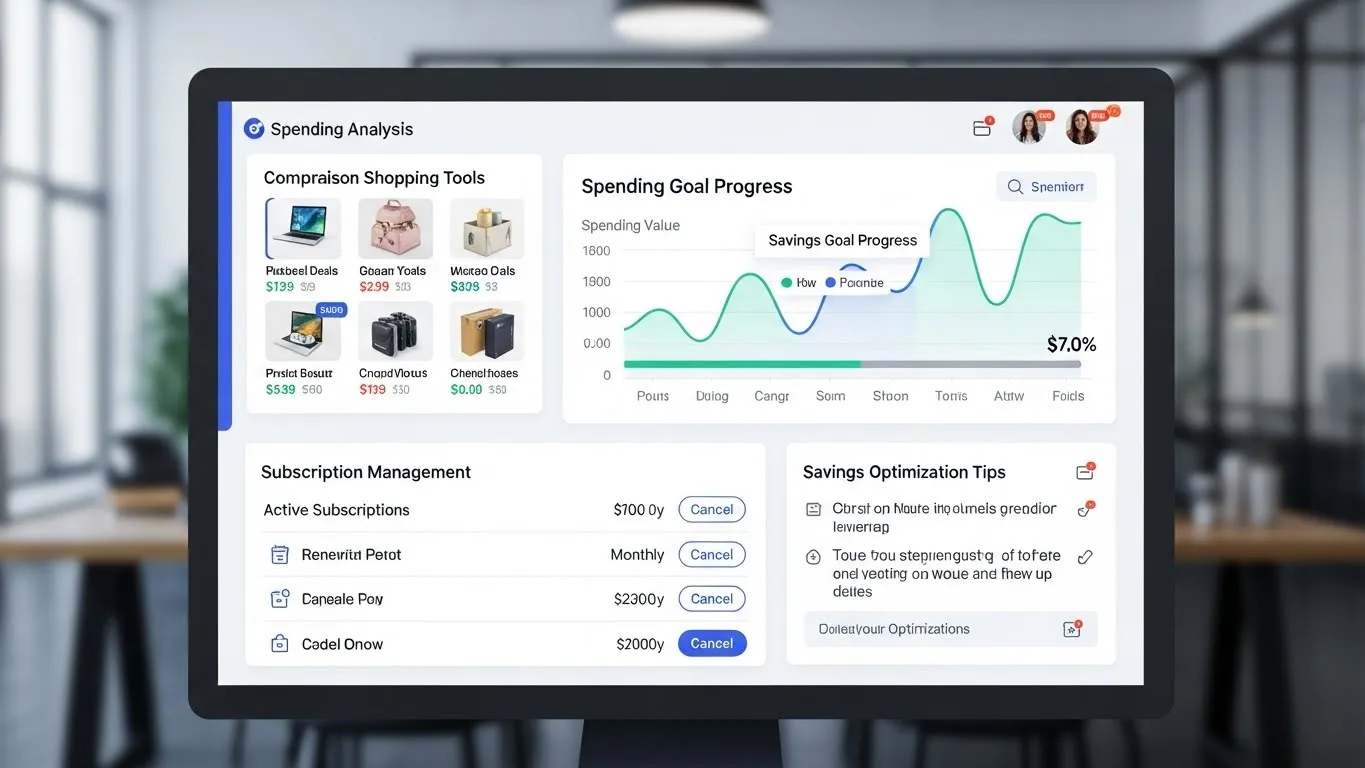

Create a Detailed Budget

A budget is your financial roadmap, showing you exactly where your money goes. Start by tracking all your income and expenses for at least a month. Use tools or apps to categorize spending and identify areas where you can save. The goal is to ensure your income exceeds your expenses, creating a surplus for savings and investments. Understanding your cash flow is non-negotiable for long-term success.

Tackle High-Interest Debt

High-interest debt, such as credit card balances or personal loans, acts as a significant drag on your progress toward financial freedom. Prioritize paying these off aggressively. Strategies like the debt snowball or debt avalanche can provide a structured approach. Every dollar freed from debt payments can then be redirected towards building your future wealth. This step significantly boosts your journey towards sustainable financial independence.

Establish an Emergency Fund

An emergency fund is your financial safety net, typically covering 3 to 6 months of living expenses. This fund protects you from unexpected job loss, medical emergencies, or large unplanned expenses, preventing you from going into debt and derailing your progress. Keep this money in a separate, easily accessible savings account. According to a 2024 report by Fidelity Investments, early savers who prioritize emergency funds typically face fewer financial setbacks.

Key Milestones on Your Path to Financial Freedom

As you move forward in mapping your path to financial freedom, you'll encounter several important milestones. Each step represents significant progress and provides a sense of accomplishment, propelling you towards your ultimate goal.

Milestone 1: Debt-Free Living (Excluding Mortgage)

Achieving a debt-free status, beyond your mortgage, is a monumental milestone. It frees up a substantial portion of your income, which can then be channeled directly into investments. This stage marks the true beginning of accelerated wealth accumulation and solidifies your financial independence journey.

Milestone 2: Building Your Investment Portfolio

Once high-interest debt is conquered and your emergency fund is robust, the focus shifts to strategic investing. This is where your money starts working for you through compound interest.

Diversified Investment Strategies

Don't put all your eggs in one basket. A diversified portfolio spreads your investments across various asset classes like stocks, bonds, real estate, and potentially even alternative assets. This approach helps mitigate risk and enhances long-term growth potential. Consider broad-market index funds and ETFs for low-cost, diversified exposure. As echoed in a 2025 study from the Journal of Financial Planning, diversified portfolios are consistently shown to be effective for long-term growth. To learn more about robust portfolio construction, explore smart investment diversification strategies for long-term wealth.

Embracing Automated Investing

Consistency is paramount in investing. Set up automated transfers from your checking account to your investment accounts. Whether it's bi-weekly or monthly, regular contributions ensure you're always investing, regardless of market fluctuations. This practice leverages dollar-cost averaging and removes emotional decision-making.

Milestone 3: Generating Passive Income Streams

Passive income is the lifeblood of financial freedom. It's income that requires minimal ongoing effort to earn. This is a critical component for sustainable independence.

Exploring Income Optimization and Side Hustles

While your main job provides primary income, exploring effective budgeting techniques and maximizing your income through side hustles can accelerate your journey. Consider skills you have that can be monetized outside your regular work hours. This could range from freelance writing or consulting to starting an e-commerce store. For deeper insights into this, check out our category on /categories/income-optimization-and-side-hustles.

Real Estate and Dividend Investments

Investing in dividend-paying stocks or real estate (through REITs or direct ownership) can provide consistent passive income. Dividends offer regular payouts, while rental properties can generate monthly income and long-term appreciation. These strategies are powerful for mapping your path to financial freedom as they create income independent of your active labor.

Advanced Strategies and Differentiated Insights

Beyond the core milestones, several advanced strategies and unique perspectives can significantly enhance your journey toward financial freedom.

Behavioral Finance: Mastering Your Money Mindset

One often-overlooked aspect of financial independence is behavioral finance. Our emotions and biases frequently lead to irrational financial decisions. Understanding and managing these psychological pitfalls can be a game-changer. For instance, avoiding herd mentality during market downturns or resisting impulse purchases are crucial for maintaining long-term discipline. Cultivating a mindset of delayed gratification and resilience is just as important as the investment strategies themselves.

Building a Personalized Financial Ecosystem

Instead of viewing financial tools and strategies in isolation, consider them as interconnected components of a personalized financial ecosystem. This involves integrating your budgeting tools, investment platforms, passive income ventures, and even health and wellness planning (as health impacts wealth). This holistic approach ensures all elements work in synergy, optimizing your journey toward sustainable independence. In my experience as a financial strategist, those who adopt this integrated view achieve their goals more efficiently and resiliently, adapting to life's inevitable changes. The Brookings Institution's 2023 analysis highlighted the critical role of financial literacy in building generational wealth, underscoring the importance of this integrated understanding.

FAQ: Your Path to Financial Freedom

Q1: What is the most crucial first step in mapping your path to financial freedom?

A1: The most crucial first step is defining what financial freedom means to you personally, followed by creating a clear, detailed budget. Understanding your current financial landscape and setting specific, measurable goals based on your vision provides the necessary direction and motivation to start your journey effectively. Without this clarity, your efforts may lack focus and impact.

Q2: How long does it typically take to achieve financial freedom?

A2: The timeline for achieving financial freedom varies greatly depending on individual factors like current income, expenses, debt levels, savings rate, and investment returns. For some, it might take 10-15 years with aggressive saving and investing, while for others, it could be 20-30 years. Consistent effort, smart choices, and a high savings rate significantly accelerate the process.

Q3: Is it possible to achieve financial freedom on an average income?

A3: Absolutely. Achieving financial freedom on an average income is entirely possible, though it often requires more discipline, creativity, and patience. Strategies like aggressive budgeting, eliminating debt, exploring side hustles to boost income, and consistent, long-term investing become even more critical. It's about optimizing what you have and making smart financial decisions, not necessarily about earning a massive salary.

Q4: What are the biggest obstacles to achieving sustainable independence?

A4: The biggest obstacles often include high-interest consumer debt, uncontrolled spending (lifestyle inflation), lack of financial literacy, emotional investing decisions, and procrastination. Overcoming these requires discipline, continuous learning, and a proactive approach to managing your finances rather than letting them manage you.

Your Journey Continues: Embrace the Future

Mapping your path to financial freedom is an ongoing journey that requires dedication, continuous learning, and adaptability. By systematically hitting these key milestones—from debt elimination to generating passive income—you are building a robust framework for long-term wealth and peace of mind. Remember, the goal is not just to accumulate assets, but to create a life of purpose and sustainable independence.

Take the Next Step Today!

Ready to accelerate your journey? Start by auditing your current spending, commit to eliminating high-interest debt, and set up automated investments. Share your biggest financial freedom challenge in the comments below – let's learn and grow together! Don't forget to subscribe for more insights on income optimization and side hustles.

Further Reading & Future Topics:

- Advanced Tax Planning for Wealth Preservation: Optimize your tax strategy to keep more of your earnings.

- Navigating Market Volatility: A Guide for Long-Term Investors: Learn to stay calm and strategic during economic shifts.

- The Psychology of Money: Overcoming Behavioral Biases: Deep dive into the mental aspects of successful wealth management.