Estimating Your Retirement Needs: How Much Money Do You Really Need to Retire?

Estimating Your Retirement Needs: How Much Money Do You Really Need to Retire?

Retirement isn't just a destination; it's a carefully planned journey. One of the most critical questions on this path is: how much money do you really need to retire? This question, central to estimating your retirement needs, can feel daunting, but breaking it down into manageable steps makes it accessible. Understanding your post-retirement lifestyle, accounting for inflation, and strategizing your investments are key to securing a comfortable future. This guide will walk you through the essential calculations and considerations to help you confidently answer this pivotal question.

Key Points for Estimating Your Retirement Needs:

- Define Your Retirement Lifestyle: Your desired post-retirement activities heavily influence your financial needs.

- Calculate Annual Expenses: Projecting your yearly costs, including healthcare, is fundamental.

- Account for Inflation: The rising cost of living significantly impacts long-term savings goals.

- Understand Withdrawal Strategies: The "4% Rule" and other methods guide how much you can safely spend.

- Start Early and Automate: Consistent, automated savings and investments are powerful tools for reaching your goals.

Unpacking Your Retirement Lifestyle: What Do You Envision?

Before you can calculate numbers, you must define the life you want to live in retirement. Will you be a globetrotter, a homebody pursuing hobbies, or perhaps working part-time? Your desired lifestyle directly influences how much money do you really need to retire. Think beyond basic living expenses and consider your aspirations.

Crafting Your Post-Retirement Budget

Start by imagining a typical month in retirement. What will your days look like?

- Housing: Will you pay off your mortgage, downsize, or move to a lower-cost area?

- Transportation: Will you drive less, rely on public transport, or travel extensively?

- Food: Will you dine out frequently or cook more at home?

- Healthcare: This is a major factor. Consider out-of-pocket costs, Medicare premiums, and potential long-term care needs.

- Leisure & Hobbies: Travel, golf, gardening, classes – these all come with costs.

- Miscellaneous: Don't forget unexpected expenses or gifts.

Many financial experts suggest aiming for 70-80% of your pre-retirement income as a starting point for your retirement expenses. However, this is a general guideline. Some might need more, especially if planning extensive travel or expensive hobbies, while others might need less if they've paid off their home and have minimal debt. A personalized assessment is always best.

The Math Behind Retirement: Calculating Your Number

Once you have a clearer picture of your desired lifestyle, it’s time to crunch some numbers. This involves projecting your annual expenses and then multiplying that by your expected retirement duration.

Projecting Your Annual Retirement Expenses

Let’s create a detailed projection of your annual expenses. Take your current budget and adjust it for retirement. For instance, commuting costs might disappear, but healthcare expenses often rise.

- Fixed Costs: Mortgage (if any), property taxes, insurance, utilities, internet.

- Variable Costs: Groceries, dining out, entertainment, clothing, personal care.

- Healthcare Costs: Medicare Part B premiums, Medigap or Medicare Advantage plans, prescription drugs, dental, vision, and potential long-term care insurance. A 2025 projection by the Centers for Medicare & Medicaid Services (CMS) indicates that average out-of-pocket healthcare spending for retirees will continue its upward trend, making it a critical component of estimating your retirement needs.

- Travel & Leisure: Allocate funds for vacations, hobbies, and social activities.

A useful exercise is to conduct a "Pre-Retirement Trial Budget." Live for 6-12 months on your projected retirement budget. This offers invaluable insights into your actual spending habits and helps refine your estimates, providing a more tangible answer to how much money do you really need to retire.

The Impact of Inflation on Your Retirement Savings Goals

Inflation erodes purchasing power over time. A dollar today will buy less in 20 or 30 years.

- Example: If your annual retirement expenses are $50,000 today, with a 3% annual inflation rate, you'll need approximately $90,300 per year in 20 years to maintain the same lifestyle.

- Always factor in an average inflation rate (historically around 2-3%) when calculating your future needs. This is a crucial, often underestimated, part of retirement planning.

The Safe Withdrawal Rate (SWR) and the "4% Rule"

A common guideline for sustainable retirement income is the "4% Rule." This rule suggests that you can safely withdraw 4% of your initial retirement portfolio value in your first year of retirement, and then adjust that amount for inflation each subsequent year, with a high probability of your money lasting 30 years or more.

- How it works: If you aim to spend $60,000 per year in retirement, you would need a portfolio of $1,500,000 ($60,000 / 0.04 = $1,500,000).

- Considerations: While widely cited, the 4% Rule has been debated, especially in periods of low returns or high inflation. Some advisors suggest a more conservative 3.5% or even 3% withdrawal rate, particularly for longer retirement horizons or for those seeking greater certainty. A 2024 study by the Transamerica Center for Retirement Studies highlighted the increasing complexity of safe withdrawal strategies amidst market volatility, emphasizing personalized advice.

Differentiated Strategies for Modern Retirement Planning

Beyond traditional calculations, adopting dynamic strategies and leveraging modern tools can significantly enhance your retirement security.

Integrating Dynamic Financial Modeling with AI Insights

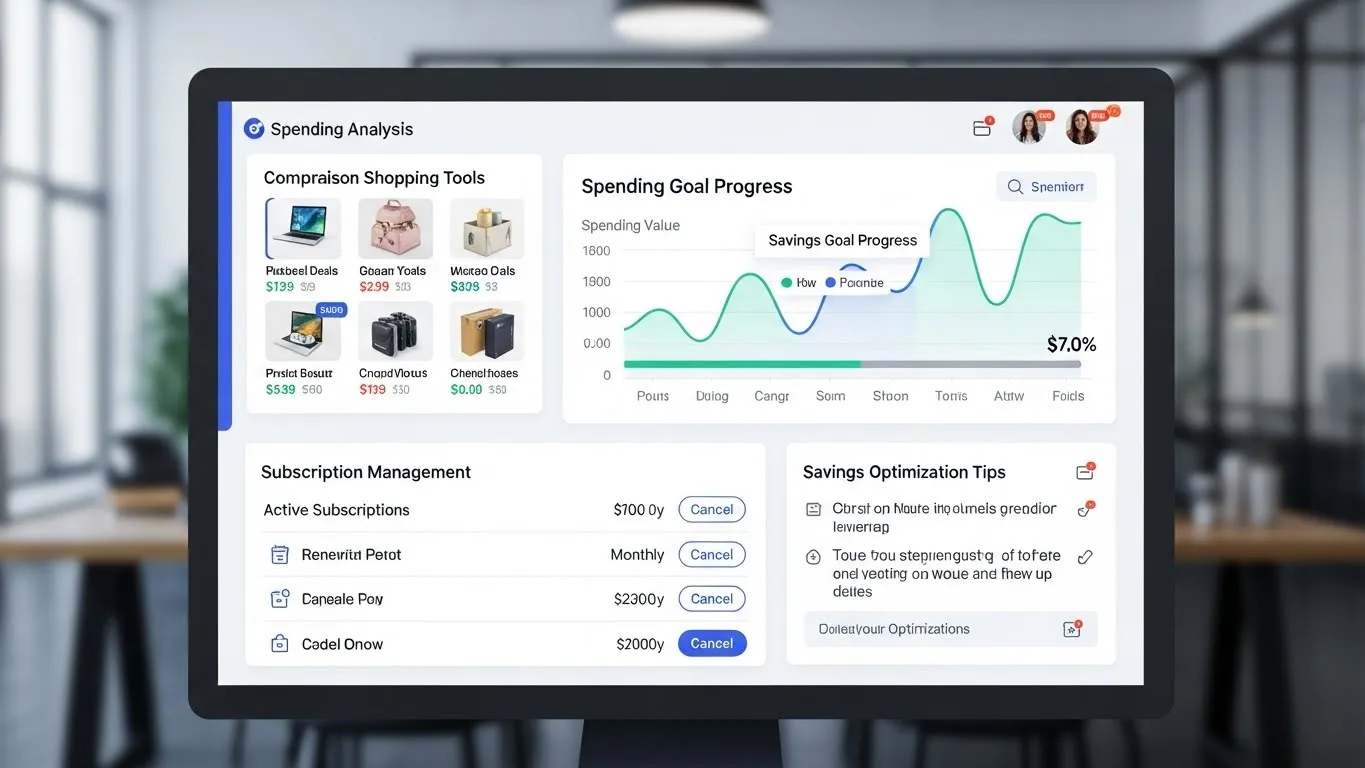

The financial landscape is ever-evolving, and static retirement plans can quickly become outdated. This is where dynamic financial modeling, often powered by artificial intelligence, offers a differentiated advantage. Instead of a one-time calculation, AI-driven tools can continuously monitor market performance, inflation rates, and even your spending habits, providing real-time adjustments and projections for your retirement portfolio. This enables more agile decision-making, helping you adapt your savings or investment strategies to keep pace with changing economic realities and personal circumstances.

Beyond the Standard: Alternative Income Streams in Retirement

Relying solely on investment withdrawals can be risky. Differentiate your plan by exploring alternative income streams:

- Part-time Work: Many retirees enjoy working a few hours a week for extra income or social engagement.

- Rental Properties: Income from real estate can supplement your portfolio.

- Side Gigs/Consulting: Monetize a hobby or past professional experience.

- Annuities: A portion of your savings can be converted into a guaranteed income stream, providing a predictable base.

Maximizing Your Retirement Savings: Practical Steps

Estimating your retirement needs is just the first step; funding them is the next. Proactive savings and smart investing are crucial.

Leverage Employer-Sponsored Plans

- 401(k)s, 403(b)s, and 457s: Maximize contributions, especially if your employer offers a match. This is essentially free money.

- Roth vs. Traditional: Understand the tax implications. Roth contributions are after-tax but grow tax-free, while traditional contributions are pre-tax, with taxes paid in retirement.

Utilize Individual Retirement Accounts (IRAs)

- Traditional IRA: Tax-deductible contributions (for some), tax-deferred growth.

- Roth IRA: After-tax contributions, tax-free growth and withdrawals in retirement.

- Contribution Limits: Be aware of annual contribution limits for both types of IRAs.

The Power of Automation and Consistent Contributions

One of the most effective strategies is to automate your investment strategy. Set up automatic transfers from your checking account to your retirement accounts (401k, IRA, brokerage). This "set it and forget it" approach ensures consistent contributions, even when life gets busy. For insights on making your money work harder, consider learning how to automate your investment strategy. The consistent compounding of returns over decades is a powerful force for wealth accumulation.

Managing Debt and Building an Emergency Fund

Before significantly boosting retirement savings, it's wise to tackle high-interest debt. Also, ensure you have a robust emergency fund. This financial cushion prevents you from dipping into your retirement savings for unexpected expenses, thereby protecting your long-term growth. To secure your financial foundation, it's important to build a robust emergency fund.

Frequently Asked Questions (FAQ)

Q: How do I know if I'm saving enough for retirement?

A: A good starting point is to regularly review your progress against financial milestones. Fidelity's 2023 Retirement Savings Guidelines suggest aiming to have 1x your salary saved by age 30, 3x by 40, 6x by 50, and 8x by 60. Use online calculators and consult a financial advisor to personalize these benchmarks based on your specific income, expenses, and desired retirement age.

Q: What if I start saving late for retirement? Is it still possible to catch up?

A: While starting early is ideal, it's never too late to begin saving. Focus on aggressive contributions, especially if you're over 50 and eligible for catch-up contributions to 401(k)s and IRAs. Consider trimming discretionary expenses, exploring part-time work in retirement, or delaying retirement by a few years to allow your savings more time to grow and compound.

Q: How do healthcare costs impact my retirement budget?

A: Healthcare is often one of the largest and most unpredictable expenses in retirement. Factor in Medicare premiums (Parts B, D), supplemental insurance (Medigap or Medicare Advantage), prescription drugs, and potential long-term care needs. A couple retiring at age 65 in 2024 can expect to spend over $300,000 on healthcare throughout their retirement, excluding long-term care, according to industry estimates.

Q: Should I include Social Security in my retirement calculations?

A: Yes, Social Security benefits can provide a crucial income stream. However, it's wise to view it as a supplement rather than your sole source of income. Obtain your estimated benefits statement from the Social Security Administration, but factor it in conservatively. Future changes to the system could impact benefit levels, so don't rely on it entirely for estimating your retirement needs.

Conclusion: Your Path to a Secure Retirement

Estimating your retirement needs is more than just a number; it's about crafting the blueprint for your future freedom. By carefully defining your desired lifestyle, projecting expenses, accounting for inflation, and adopting smart saving and investing strategies, you can confidently determine how much money do you really need to retire. Remember, consistency and automation are your best allies in this journey.

Ready to take control of your financial future? Start by evaluating your current budget, setting clear retirement goals, and then exploring strategies to automate your savings and investments. Share your retirement planning insights and questions in the comments below! For more expert advice on optimizing your savings and investments, explore our Savings and Investment Automation category.

Extended Reading Suggestions:

- The Nuances of Early Retirement: Dive deeper into the Financial Independence, Retire Early (FIRE) movement and its various approaches.

- Navigating Retirement Withdrawals: A comprehensive guide to different withdrawal strategies beyond the 4% rule.

- Long-Term Care Planning: Understanding the costs and options for future healthcare needs.