Early Retirement Planning: Strategies to Accelerate Your Journey to Financial Independence

Early Retirement Planning: Strategies to Accelerate Your Journey to Financial Independence

Embarking on early retirement planning can transform your financial future, leading you towards a life of greater freedom and purpose. This comprehensive guide will equip you with actionable strategies to accelerate your journey to financial independence (FI). We'll delve into effective savings techniques, smart investment approaches, and unique tax considerations that can significantly shorten your working years. Achieving early retirement isn't just a dream; it's a tangible goal attainable through diligent planning and consistent execution.

Key Points for Accelerating Early Retirement

- Define Your FI Number: Clearly calculate the capital needed to cover your desired annual expenses.

- Maximize Savings Rate: Prioritize aggressive saving, aiming for 50% or more of your income.

- Optimize Investments: Utilize low-cost, diversified investment vehicles for compound growth.

- Strategize Tax Efficiency: Plan for early withdrawal tax implications and optimize accounts.

- Boost Income Streams: Explore side hustles or career growth to increase your earning potential.

Understanding the Landscape of Financial Independence and Early Retirement

The concept of early retirement is often intertwined with the Financial Independence, Retire Early (FIRE) movement. At its core, early retirement planning is about accumulating enough passive income-generating assets to cover your living expenses, thereby eliminating the need to work for a paycheck. This journey isn't a one-size-fits-all path; it involves personalizing strategies based on your lifestyle aspirations, risk tolerance, and current financial situation. It demands a shift in mindset, prioritizing long-term financial health over immediate gratification.

Defining Your Financial Independence Number

The cornerstone of any early retirement planning strategy is accurately determining your "FI number." This is the total amount of capital you need saved and invested to sustain your desired lifestyle without working. A widely accepted guideline is the "25x rule," which suggests multiplying your desired annual expenses by 25. For example, if you aim to live on $60,000 per year, your FI number would be $1.5 million.

However, a more nuanced approach, and a key differentiator in modern planning, involves segmenting your expenses. Instead of a blanket 25x rule, consider:

- Fixed Essential Expenses (Housing, Food, Healthcare): Multiply these by 25x or even 30x for a safer margin, as they are non-negotiable.

- Variable Lifestyle Expenses (Travel, Hobbies): You might apply a lower multiplier (e.g., 20x) or plan to cover these with part-time work or side income in early retirement, offering flexibility.

- One-Time or Future Large Expenses (New Car, Home Renovation): Plan for these separately, perhaps through a dedicated sinking fund or by increasing your overall FI number.

This segmented approach provides a more realistic and less intimidating target, allowing for greater customization and peace of mind. According to a 2024 report by the Global Financial Literacy Council, individuals who meticulously plan their expenses demonstrate significantly higher success rates in achieving financial goals.

Aggressive Savings Strategies for Accelerating Financial Independence

To truly accelerate your journey to financial independence, an aggressive savings rate is paramount. This goes beyond the traditional 10-15% recommended for standard retirement. Many early retirees aim for 50% or even 70% of their income. This high savings rate significantly reduces the time it takes to reach your FI number, thanks to the power of compound interest.

Boosting Your Savings Rate Through Smart Spending

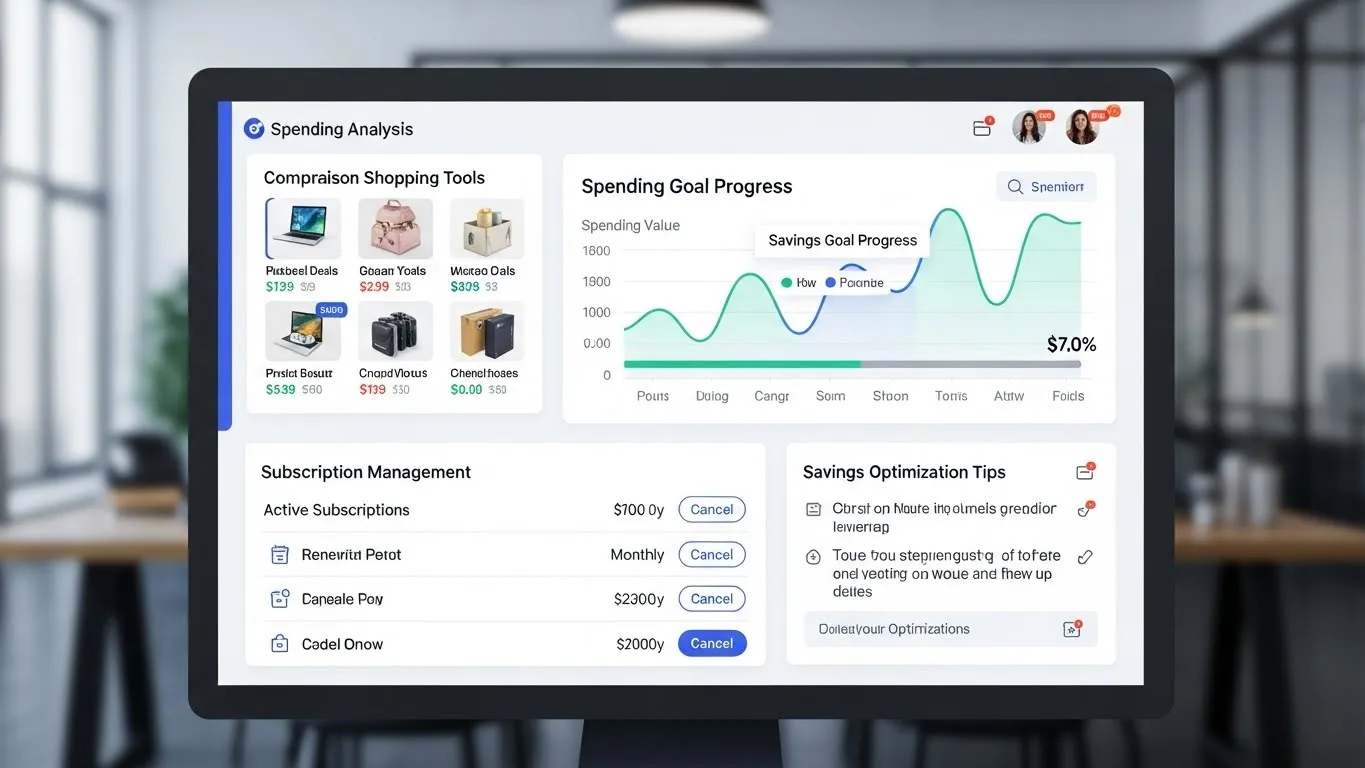

Increasing your savings rate involves a dual approach: boosting income and reducing expenses. For effective expense reduction, cultivating smart spending habits is crucial. This means meticulously tracking your outflows and identifying areas where you can cut back without sacrificing your quality of life. Consider optimizing housing costs, which often represent the largest expense. This might involve downsizing, house hacking, or exploring geoarbitrage if your work allows.

Effective budgeting is non-negotiable. For a deep dive into mastering your money, consider our guide on budgeting for financial freedom. This resource can help you identify wasteful spending and reallocate funds towards your savings goals.

Maximizing Your Income Potential

While cutting expenses is vital, increasing your income can have an even greater impact on your savings rate. This isn't just about earning more; it's about strategically increasing your income to accelerate your early retirement planning.

- Skill Development and Career Advancement: Invest in education or certifications that can lead to higher-paying roles within your current industry.

- Side Hustles and Freelancing: Monetize hobbies or skills outside your primary job. This extra income can be directed entirely towards savings.

- Negotiating Salaries: Regularly assess your market value and confidently negotiate for higher compensation.

Intelligent Investment Strategies for Early Retirement

Once you've maximized your savings, the next critical step is to invest those funds wisely to ensure they grow efficiently. Early retirement planning relies heavily on the growth of your investment portfolio.

Diversified and Low-Cost Investment Vehicles

The most effective strategy for long-term wealth accumulation, favored by many in the FIRE community, involves investing in low-cost, diversified index funds or exchange-traded funds (ETFs). These vehicles offer broad market exposure, minimize fees, and historically provide robust returns over the long term. For more information on this approach, explore our article on investing in low-cost index funds.

- Index Funds/ETFs: These track a market index (like the S&P 500), offering diversification and lower risk than individual stocks.

- Brokerage Accounts: Utilize tax-advantaged accounts like 401(k)s and IRAs first, then taxable brokerage accounts for funds accessible before traditional retirement age.

- Automated Investing: Set up automatic contributions to ensure consistency and remove emotion from investing.

Research published in the Journal of Financial Planning in late 2023 consistently highlights the effectiveness of diversified index fund portfolios for long-term wealth accumulation, often outperforming actively managed funds after fees.

Strategic Asset Allocation and Rebalancing

Your asset allocation should reflect your risk tolerance and time horizon. Younger individuals with a longer runway to retirement might lean heavily into equities, while those closer to their FI number might gradually introduce more bonds to reduce volatility. Regularly rebalance your portfolio to maintain your desired allocation, ensuring you're not overly exposed to any single asset class.

Navigating Taxes in Early Retirement: Differentiated Strategies

One of the most unique aspects of early retirement planning is navigating tax implications when accessing funds before age 59½. Standard retirement advice often doesn't address the specific needs of early retirees.

The Roth Conversion Ladder

A popular strategy among early retirees is the Roth conversion ladder. This involves converting pre-tax retirement funds (like from a traditional IRA or 401(k)) into a Roth IRA. After a five-year waiting period for each conversion, these converted funds can be withdrawn tax-free and penalty-free, regardless of age. This allows early access to retirement savings without incurring penalties for early withdrawal. Carefully planning your conversions can keep you in a lower tax bracket during your early retirement years.

Rule 72(t) and Substantially Equal Periodic Payments (SEPPs)

Another option for early access to retirement funds without penalty is through "Substantially Equal Periodic Payments" (SEPPs), often referred to as Rule 72(t) distributions. This involves taking a series of equal payments from your IRA based on your life expectancy. While effective, these payments must continue for at least five years or until age 59½, whichever is longer, and any deviation can result in significant penalties. This strategy requires careful calculation and commitment.

Overcoming Challenges and Maintaining Momentum

The journey to financial independence isn't always linear. You may encounter setbacks, market downturns, or shifts in personal circumstances. It's crucial to cultivate resilience and maintain your motivation throughout the process.

- Stay Educated: Continuously learn about personal finance and investment strategies.

- Find Your Community: Engage with others on the FIRE path for support and shared experiences.

- Celebrate Milestones: Acknowledge and celebrate small victories along the way to keep morale high.

Frequently Asked Questions About Early Retirement Planning

Q: How much money do I actually need to retire early?

A: The amount varies significantly based on your desired annual expenses and lifestyle. A common rule of thumb is 25 times your annual expenses. So, if you plan to spend $50,000 per year, you'd need $1.25 million. However, a personalized approach considering fixed vs. variable expenses can provide a more accurate and attainable target for your specific situation.

Q: What is the "4% rule" in early retirement planning?

A: The 4% rule suggests that you can safely withdraw 4% of your investment portfolio each year in retirement, adjusted for inflation, without running out of money. This rule is based on historical market data and aims to provide a sustainable withdrawal rate. It's a guideline, and some early retirees opt for a more conservative 3-3.5% withdrawal rate for added security.

Q: Can I retire early without a high income?

A: Yes, absolutely. While a high income can accelerate the process, early retirement is more about your savings rate than your absolute income. By aggressively reducing expenses and maximizing what you save, individuals with moderate incomes can also achieve financial independence. The key is to create a significant gap between your income and your expenses, directing the surplus to investments.

Q: How long does early retirement planning typically take?

A: The timeline for early retirement planning depends heavily on your savings rate, investment returns, and starting capital. With a savings rate of 50%, you could potentially reach financial independence in about 17 years. A 70% savings rate could shorten that to around 8-10 years. It's a marathon, not a sprint, but consistent effort yields significant results.

Your Path to Financial Freedom Starts Now

Embarking on early retirement planning is one of the most empowering financial decisions you can make. By diligently applying these strategies—from calculating your nuanced FI number to leveraging tax-efficient withdrawal methods—you can significantly accelerate your journey to financial independence. Remember, consistency and adaptability are your greatest assets.

We encourage you to share your thoughts or questions in the comments below, and consider subscribing to our newsletter for more insights on smart spending and frugal living. For further reading, explore our category on smart spending and frugal living to deepen your understanding of these transformative principles.

Future Topics to Explore:

- Geographic Arbitrage and Its Role in Early Retirement

- Building Passive Income Streams Beyond the Stock Market

- Healthcare Strategies for Early Retirees