Creating Your First Personal Budget: Practical Steps to Manage Income and Expenses Effectively

Creating Your First Personal Budget: Practical Steps to Manage Income and Expenses Effectively

Embarking on your financial journey often begins with a single, powerful step: creating your first personal budget. This isn't just about restricting spending; it's about gaining clarity, control, and confidence over your money. A well-structured budget serves as a roadmap, guiding your financial decisions and helping you allocate your resources purposefully. It's the essential tool for managing income and expenses effectively, ensuring you meet your financial goals, whether it's saving for a down payment, paying off debt, or building an emergency fund. This guide will walk you through practical, actionable steps to build a budget that truly works for you, transforming your financial outlook.

Key Points for Getting Started

- Understand Your Cash Flow: Know exactly how much money comes in and goes out.

- Track Everything: Monitor all spending, no matter how small.

- Categorize Wisely: Group expenses to identify spending patterns.

- Set Clear Goals: Define what you want your money to achieve.

- Regularly Review: Adjust your budget as life changes.

Understanding Why Creating Your First Personal Budget is Essential

Many people approach budgeting with trepidation, seeing it as a tedious chore. However, the reality is that creating your first personal budget is a liberating experience. It provides a crystal-clear picture of your financial health, allowing you to make informed decisions rather than guessing. Without a budget, it's easy for money to slip through your fingers, leaving you wondering where it all went.

A robust personal budget empowers you to:

- Identify Overspending: Pinpoint areas where you might be spending more than you realize or intend.

- Allocate Funds Strategically: Direct your money towards priorities like savings, debt repayment, or investments.

- Reduce Financial Stress: Knowing you have a plan can significantly lower anxiety about money.

- Achieve Financial Goals Faster: Whether short-term or long-term, a budget accelerates your progress.

In an increasingly complex financial landscape, a budget is your anchor. According to a 2024 survey by the National Financial Wellness Institute, individuals who consistently budget report a 35% higher sense of financial security compared to those who don't. This underscores the profound impact managing income and expenses effectively can have on overall well-being.

Practical Steps to Build Your Budget Effectively

Creating your first personal budget doesn't have to be complicated. By breaking it down into manageable steps, you can establish a system that empowers you rather than overwhelms.

Step 1: Assess Your Current Financial Situation

Before you can plan where your money will go, you need to understand where it currently stands. This involves a clear-eyed look at all your income sources and existing debts.

- List All Income:

- Net Paycheck: Your take-home pay after taxes and deductions.

- Side Gigs/Freelance Income: Any additional earnings.

- Rental Income: From properties you own.

- Benefits: Social security, unemployment, child support, etc.

- Tip: Be realistic about variable income; base your budget on a conservative estimate.

- Identify Your Debts:

- Credit Cards: List balances, interest rates, and minimum payments.

- Student Loans: Note lenders, balances, and monthly payments.

- Car Loans: Loan amount and monthly payments.

- Mortgage/Rent: Your largest housing expense.

Understanding these foundational numbers is the bedrock upon which you'll build your entire budget.

Step 2: Track Your Income and Expenses Meticulously

This is perhaps the most crucial step in creating your first personal budget. For one month, track every single dollar that comes in and goes out. This isn't about judging your spending; it's about observation.

- Choose a Tracking Method:

- Spreadsheet: Google Sheets or Excel offers flexibility.

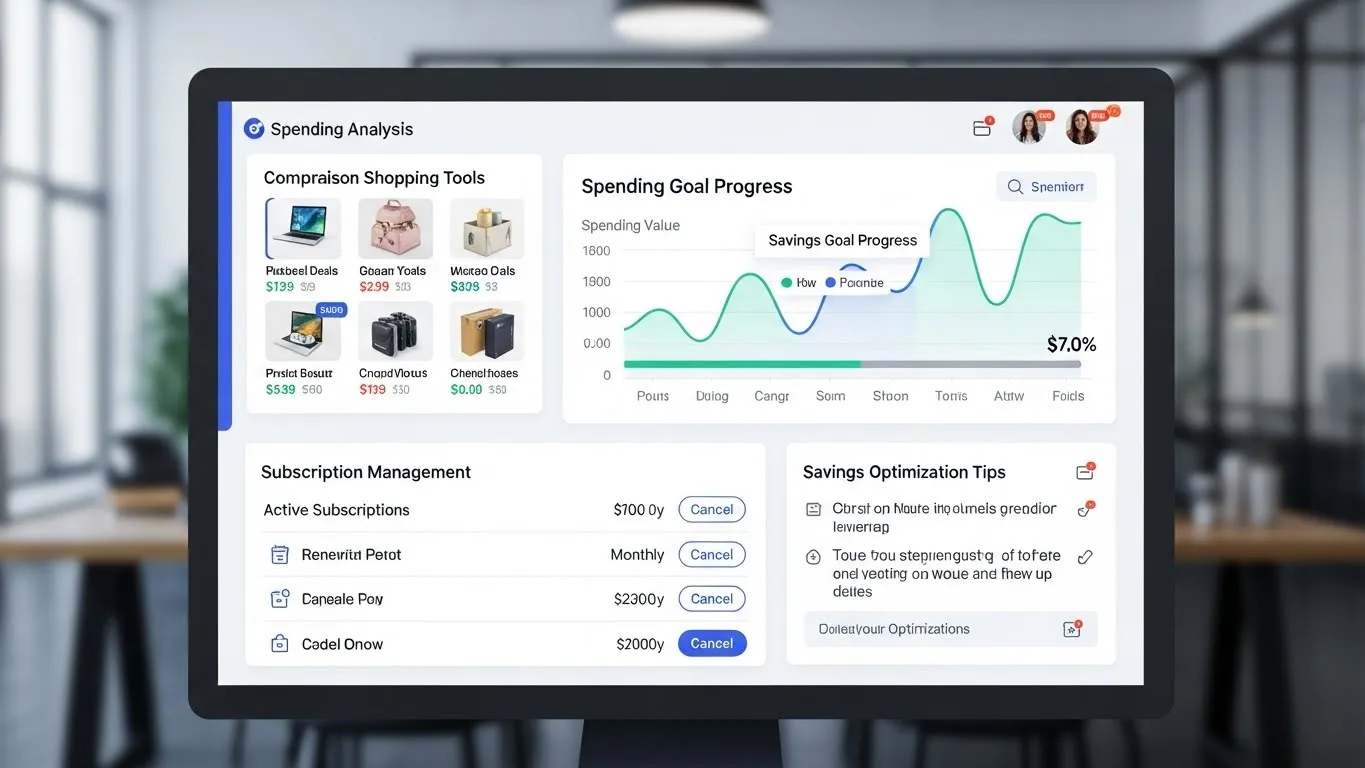

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), or Personal Capital link directly to your accounts.

- Notebook & Pen: Simple and effective for those who prefer tangible tracking.

- Pro Tip: For a beginner, linking bank accounts to an app can automate much of this process, providing instant insights into your spending habits.

- Record Everything: From your morning coffee to your monthly rent, every transaction matters. Seeing where your money truly goes is often an eye-opening experience. This detailed tracking will highlight patterns you might not have noticed.

For more in-depth advice on this step, consider exploring articles on how to track expenses effortlessly.

Step 3: Categorize Your Spending for Clarity

Once you've tracked your expenses for a month, it's time to group them into meaningful categories. This helps you visualize where your money is going and identify areas for potential adjustment.

- Common Budget Categories:

- Housing: Rent/mortgage, utilities, home insurance.

- Transportation: Car payment, gas, public transit, maintenance.

- Food: Groceries, dining out, coffee.

- Utilities: Electricity, water, internet, cell phone.

- Debt Payments: Credit cards, loans.

- Personal Care: Haircuts, toiletries.

- Entertainment: Movies, hobbies, nights out.

- Savings: Emergency fund, retirement, specific goals.

- Miscellaneous: Small, infrequent purchases.

Be as specific as possible. For instance, instead of just "Food," differentiate between "Groceries" and "Restaurant Dining" to understand where your food budget truly lies.

Step 4: Set Realistic Financial Goals

What do you want your money to do for you? Creating your first personal budget is a tool to achieve these aspirations. Your goals should be S.M.A.R.T. (Specific, Measurable, Achievable, Relevant, Time-bound).

- Examples of Financial Goals:

- Short-Term (within 1 year): Build a $1,000 emergency fund, pay off a small credit card debt.

- Mid-Term (1-5 years): Save for a down payment on a car, take a dream vacation.

- Long-Term (5+ years): Save for a house, retirement, child's education.

Make sure your goals are inspiring enough to keep you motivated. As noted by a 2023 study from the American Institute of Financial Planners, individuals with clearly defined financial goals are 2.5 times more likely to stick to their budget and achieve them.

Step 5: Allocate Funds and Create Your Budget Categories

Now, using your income, tracked expenses, and financial goals, you'll assign specific dollar amounts to each category. This is where you proactively decide where every dollar goes before you spend it.

- Fixed Expenses: These are costs that are generally the same each month (rent, loan payments, insurance premiums).

- Variable Expenses: These fluctuate month-to-month (groceries, dining out, entertainment, utilities). Estimate these based on your tracking from Step 2.

- The 50/30/20 Rule: A popular guideline suggests allocating:

- 50% to Needs: Housing, utilities, groceries, transportation, minimum debt payments.

- 30% to Wants: Dining out, entertainment, hobbies, travel.

- 20% to Savings & Debt Repayment: Building an emergency fund, investing, paying off extra debt.

This framework can be incredibly helpful when creating your first personal budget. For more details on this specific strategy, check out our guide on understanding the 50/30-20 budget rule. Remember, this is a guideline, and you might adjust percentages based on your unique situation.

Step 6: Monitor and Adjust Your Budget Regularly

A budget is a living document, not a rigid set of rules. It needs regular attention to remain effective.

- Weekly Check-ins: Briefly review your spending against your budget. Are you on track?

- Monthly Review: At the end of each month, do a more thorough assessment.

- Where did you overspend?

- Where did you underspend?

- Are your income or expenses changing?

- Are your financial goals still relevant?

- Make Adjustments: If you consistently overspend in one area, consider cutting back elsewhere or increasing that category's allocation (if sustainable). Life happens, and your budget should evolve with it.

This iterative process of monitoring and adjusting is key to long-term budgeting success.

Advanced Tips for Sustaining Your Personal Budget

Beyond the basics of creating your first personal budget, there are several strategies to enhance your financial management.

- Automate Savings: Set up automatic transfers from your checking to your savings account immediately after you get paid. "Pay yourself first" ensures your financial goals are prioritized. This simple step is highly effective for building wealth. For further reading, explore saving money strategies for beginners.

- Embrace the "Zero-Based Budgeting" Approach: This method ensures every dollar has a job. You allocate every cent of your income to either an expense, savings, or debt repayment, resulting in a "zero" balance at the end of the month. This proactive approach to money management minimizes waste and maximizes intentionality.

- Build a Buffer: Include a "miscellaneous" or "buffer" category for unexpected small expenses. This prevents minor surprises from derailing your carefully planned budget and helps you stick to your financial plan.

- Conduct Quarterly "Money Dates": Set aside time each quarter, perhaps with a partner if applicable, to review your budget, financial goals, and overall progress. This allows for bigger adjustments and long-term planning.

Information Timeliness and Update Frequency Recommendations

The financial landscape, including budgeting tools and economic conditions, can shift. This article reflects current best practices for personal budgeting as of late 2025. It's recommended to revisit and update the content every 12-18 months to ensure accuracy and relevance, especially concerning any new budgeting methodologies, significant economic data from sources like the Federal Reserve, or updates in financial technology.

FAQ Section

Q: What if I can't stick to my budget?

A: It's common to struggle initially. The key is to not get discouraged. Review where you overspent and understand why. Perhaps your budget was too restrictive in certain areas, or unexpected costs arose. Adjust your allocations, create a small "buffer" category for incidentals, and be kind to yourself. Consistency, not perfection, is the goal.

Q: How often should I review my budget?

A: You should do a quick check-in at least weekly to see if you're on track with your spending. A more comprehensive review and adjustment should be performed monthly. This allows you to catch deviations early and make necessary changes, ensuring your budget remains a relevant and effective tool for managing your income and expenses.

Q: What's the best budgeting app for beginners?

A: Many excellent budgeting apps cater to beginners. Mint is popular for its automatic expense categorization and linking to various accounts. YNAB (You Need A Budget) is highly regarded for its "zero-based budgeting" philosophy and robust goal-setting features. For a simpler approach, apps like Simplifi or Personal Capital also offer user-friendly interfaces to track your financial journey.

Q: Should I include savings in my budget?

A: Absolutely! Savings should be treated as a non-negotiable expense in your budget. By allocating a specific amount to savings each month, you prioritize your financial goals and build financial security. This approach, often called "paying yourself first," ensures that you are consistently working towards your future, rather than just reacting to current expenses.

Conclusion

Creating your first personal budget is a transformative step towards financial empowerment. It’s not about deprivation; it's about gaining clarity, control, and peace of mind over your money. By meticulously tracking your income and expenses, setting clear goals, and consistently monitoring your progress, you lay the foundation for a secure and prosperous financial future. Remember, budgeting is a skill that improves with practice and adjustment.

Start today, even with small steps. Take charge of your money, and watch as your financial goals become achievable realities. We encourage you to share your budgeting journey in the comments below! What was the most challenging part of creating your first personal budget for you?

Extended Reading Suggestions

- Category: Budgeting and Expense Tracking

- Related Article: How to Set and Achieve Realistic Financial Goals

- Related Article: Investing for Beginners: A Simple Guide to Getting Started