Conquering Your Debts: Proven Methods and Mindsets for Accelerated Debt Repayment

The journey to financial freedom often feels daunting, especially when faced with a mountain of debt. But what if you could dramatically shorten that journey? This comprehensive guide dives into proven methods and powerful mindsets for accelerated debt repayment, empowering you to take control of your finances and build a more secure future. We'll explore strategic approaches to tackle various types of debt, from credit cards to student loans, alongside the crucial psychological shifts needed to maintain momentum and achieve lasting success. Prepare to transform your relationship with money and systematically eliminate your debt faster than you thought possible.

Key Points for Accelerated Debt Repayment

- Strategic Planning: Choose between snowball and avalanche methods.

- Budget Mastery: Create and stick to a realistic budget.

- Mindset Shift: Cultivate discipline and resilience.

- Income Boost: Explore ways to earn more or cut expenses.

- Avoid New Debt: Break the cycle of borrowing.

Conquering Your Debts: Proven Methods and Mindsets for Accelerated Debt Repayment

Debt can feel like a heavy burden, hindering your financial progress and causing significant stress. However, with the right strategies and a committed mindset, accelerated debt repayment is not just a dream—it's an achievable reality. This article will guide you through effective techniques and the psychological strength required to systematically eliminate your debt and reclaim your financial independence. We'll explore practical steps, from optimizing your budget to adopting powerful mental frameworks, all designed to help you pay off debt faster.

I. Understanding Your Debt Landscape

Before you can conquer your debts, you must first understand them. This involves a clear-eyed assessment of what you owe, to whom, and under what terms. Gathering all this information is the crucial first step in developing an effective debt reduction strategy.

- List All Debts: Create a comprehensive list of every debt you have. Include credit cards, personal loans, student loans, car loans, mortgages, and any other outstanding balances.

- Key Details: For each debt, note down the creditor, current balance, interest rate, minimum payment, and due date. This detailed overview provides the foundation for your repayment plan.

- Prioritize High-Interest Debt: Debts with higher interest rates cost you more money over time. Identifying these will be critical for choosing an effective payoff strategy.

II. The Power of a Solid Budget for Accelerated Debt Repayment

A budget isn't about restriction; it's about empowerment. It's your roadmap to understanding where your money goes and finding opportunities to reallocate funds towards accelerated debt repayment. Without a clear budget, even the best intentions can falter.

- Track Your Spending: For at least a month, meticulously track every dollar you spend. Use apps, spreadsheets, or a simple notebook. This step often reveals surprising spending habits.

- Create a Realistic Budget: Based on your income and tracked expenses, allocate funds for necessities (housing, food, utilities), discretionary spending, and—most importantly—debt repayment. Be honest with yourself about what you can afford.

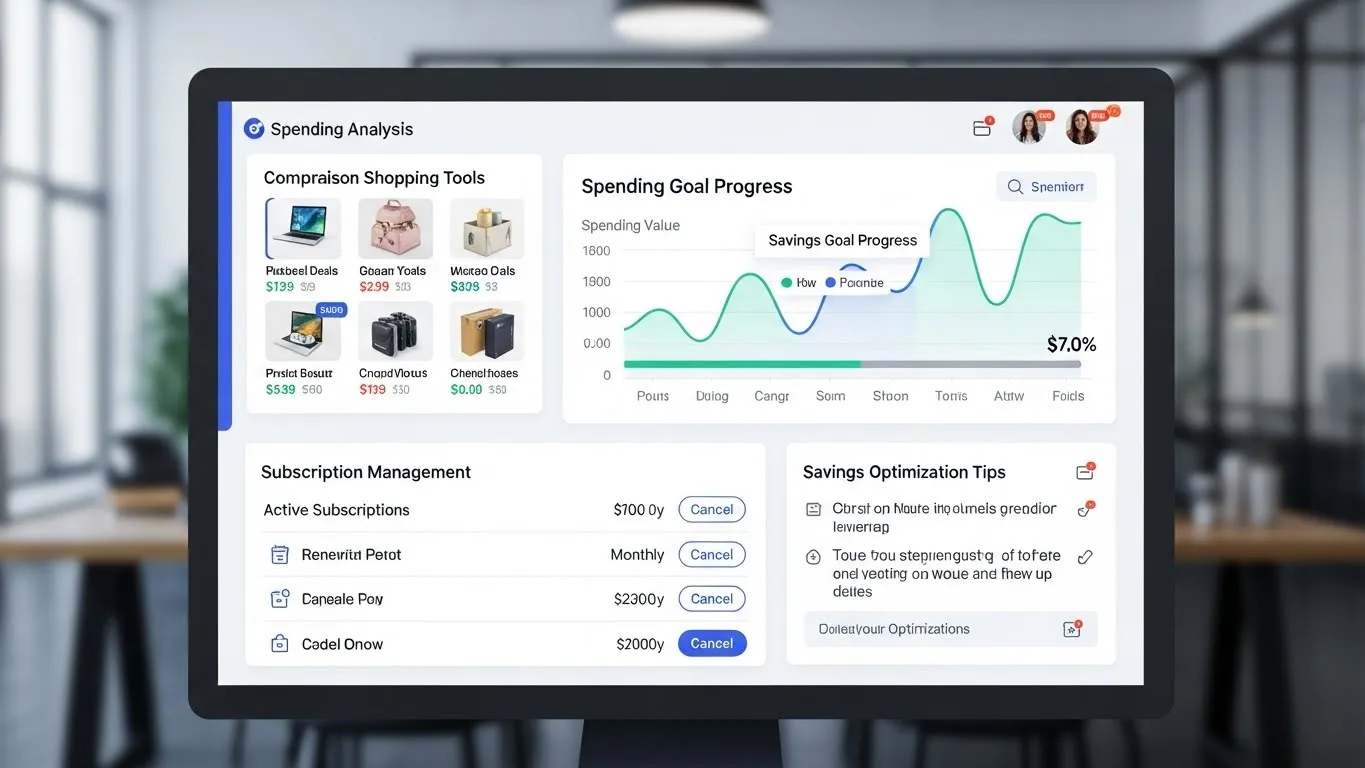

- Find "Extra" Money: Look for areas where you can cut back. Even small adjustments, like reducing dining out or canceling unused subscriptions, can free up significant funds for debt payments. Consider a detailed review of subscription services you might not actively use.

- Regular Review: Your budget isn't static. Review and adjust it monthly or quarterly to ensure it aligns with your financial goals and changing circumstances.

III. Proven Debt Payoff Methods for Faster Results

Once you have a clear picture of your debts and a functioning budget, it's time to choose a strategic repayment method. Two popular and highly effective approaches are the Debt Snowball and Debt Avalanche methods. Both aim for accelerated debt repayment, but they leverage different motivators.

- The Debt Avalanche Method:

- Strategy: List your debts from highest interest rate to lowest.

- Action: Pay the minimum on all debts except the one with the highest interest rate. Throw every extra dollar you have at that high-interest debt until it's paid off.

- Benefit: This method saves you the most money on interest over the long run. It's mathematically the most efficient approach.

- According to a 2023 financial wellness study by Fidelity, individuals who consistently prioritize high-interest debt repayment save an average of 15-20% more in interest charges compared to other methods.

- The Debt Snowball Method:

- Strategy: List your debts from smallest balance to largest.

- Action: Pay the minimum on all debts except the one with the smallest balance. Dedicate all extra funds to paying off that smallest debt. Once it's gone, take the money you were paying on it and add it to the payment of the next smallest debt.

- Benefit: This method provides powerful psychological wins as you quickly eliminate smaller debts, building momentum and motivation. It's excellent for those who need frequent encouragement.

- Behavioral economics research from Duke University in 2024 highlighted the significant motivational impact of "small wins" in financial goal achievement, reinforcing the psychological benefits of the snowball method.

Choosing between these methods depends on your personality. If you're driven by logic and saving money, the avalanche is ideal. If you need frequent wins to stay motivated, the snowball might be a better fit for your journey towards conquering your debts. For further insights into budgeting, explore our article on effective budgeting strategies for financial growth.

IV. Crucial Mindsets for Accelerated Debt Repayment

Beyond the numbers, your mindset plays a monumental role in your ability to achieve accelerated debt repayment. Developing mental resilience and discipline is just as important as choosing the right strategy.

- Embrace Delayed Gratification: Short-term sacrifices for long-term gains are central to debt repayment. Resisting impulsive purchases and consistently directing funds towards debt requires discipline.

- Cultivate Patience and Persistence: Debt repayment is a marathon, not a sprint. There will be good months and challenging ones. Celebrate small victories, learn from setbacks, and keep pushing forward.

- Focus on Financial Freedom: Shift your focus from the burden of debt to the benefits of a debt-free life. Visualize your goals—whether it's saving for a down payment, starting a business, or simply reducing stress. This positive outlook fuels your determination.

- Avoid the Blame Game: Instead of dwelling on past financial mistakes, focus your energy on constructive action. Learn from your experiences and commit to smarter financial habits moving forward.

- Seek Support, Not Isolation: Talk to trusted friends, family, or a financial advisor. Sharing your journey can provide encouragement, accountability, and valuable perspectives. Remember, you don't have to go through this alone.

V. Differentiated Strategies for Boosting Your Debt Payoff

To truly differentiate your accelerated debt repayment journey, consider these additional, often overlooked strategies:

- The Debt Recalculation Mindset: Instead of seeing your debt as a static burden, view it as a pool of capital that can be actively managed. Can you refinance high-interest debts to a lower rate? Even a 1-2% reduction can save thousands. Research recent shifts in personal loan rates or balance transfer offers. For example, some regional credit unions, as reported by Credit Karma in late 2024, are offering competitive balance transfer rates, reflecting a strategic move to attract new members.

- Strategic Side Hustles and Income Augmentation: Don't just cut expenses; actively seek to increase your income. This isn't about becoming a millionaire overnight, but even an extra $200-$500 a month from a side gig can drastically shorten your debt repayment timeline. Platforms for remote work, freelancing, or gig economy opportunities are more accessible than ever, offering flexible ways to earn. This proactive approach often yields faster results than solely focusing on frugality.

- Optimize Your Emergency Fund While Repaying: While paying down debt, it's crucial not to neglect an emergency fund. However, a full 3-6 month emergency fund might be too much to build before starting aggressive debt repayment. Aim for a smaller, foundational emergency fund (e.g., $1,000-$2,000) first. This acts as a buffer against unexpected expenses, preventing new debt from derailing your progress, then aggressively attack your debts. Once major debts are gone, you can fully fund your emergency savings. This balanced approach is often missed in standard advice.

For a broader perspective on financial management, check out our category on Debt Reduction and Payoff Strategies.

VI. FAQs on Accelerated Debt Repayment

What is the best way to start accelerated debt repayment? The best way to start is by gaining a clear understanding of all your debts—their balances, interest rates, and minimum payments. Then, create a detailed budget to identify areas where you can cut expenses and free up extra funds. Finally, choose a strategic repayment method like the Debt Avalanche (for saving money on interest) or the Debt Snowball (for building momentum) based on your financial personality and goals. Consistency is key.

How important is mindset in paying off debt quickly? Mindset is incredibly important, often as crucial as the methods themselves. Developing a mindset of delayed gratification, patience, and persistence helps you stay motivated through the long journey. Focusing on the positive outcome of financial freedom and avoiding self-blame empowers you to make consistent progress and overcome challenges without getting discouraged. It's the fuel that keeps your repayment engine running.

Should I focus on paying off my mortgage faster or other debts? Generally, it's advisable to prioritize high-interest debts like credit cards and personal loans before aggressively paying down a mortgage. Mortgages typically have much lower interest rates and tax-deductible interest in many regions, making them 'cheaper' debt. However, once high-interest debts are cleared, accelerating mortgage payments can save significant interest over the loan's lifetime and lead to full homeownership sooner, which is a powerful long-term financial goal.

How do I avoid accumulating new debt while paying off old debt? Avoiding new debt requires strict budgeting, a strong emergency fund, and a change in spending habits. Live within your means, and resist the urge for impulse purchases. Always ask yourself if an expense is a 'want' or a 'need.' Your emergency fund acts as your first line of defense against unexpected costs, preventing you from relying on credit cards. Additionally, consider temporarily 'freezing' your credit cards if temptation is high, or cutting them up to remove easy access.

VII. Your Path to Financial Freedom: A Call to Action

Conquering your debts and achieving accelerated debt repayment is one of the most empowering financial journeys you can undertake. It demands discipline, strategic planning, and an unwavering commitment to your financial well-being. By implementing the proven methods and cultivating the resilient mindsets discussed here, you are well on your way to a debt-free future.

Take the first step today: Review your debts, set up a budget, and choose a repayment method. Share your progress in the comments below – your journey can inspire others! For further reading on managing your finances effectively, check out our guide on achieving financial independence through smart saving. Subscribe to our newsletter for more expert tips and strategies to accelerate your financial goals.