Choosing the Right Budgeting Method: Envelope, Zero-Based, or 50/30/20?

Choosing the Right Budgeting Method: A Path to Financial Control

Embarking on a journey towards financial freedom often begins with a solid budget. Yet, with numerous strategies available, choosing the right budgeting method can feel overwhelming. This comprehensive guide explores three popular and highly effective approaches: the Envelope System, Zero-Based Budgeting, and the 50/30/20 Rule. Each method offers a distinct pathway to managing your money, curbing overspending, and reaching your financial aspirations. Understanding their nuances is key to finding the one that aligns perfectly with your lifestyle and goals.

Key Points

- Envelope Budgeting: Ideal for visual and tactile learners, emphasizing cash for controlled spending.

- Zero-Based Budgeting: Assigns every dollar a job, promoting intentional spending and savings.

- 50/30/20 Rule: A simple, percentages-based framework for needs, wants, and savings/debt.

- Personalization is Key: The best method is the one you can consistently stick to and adapt.

- Digital Tools: Modern apps enhance traditional methods, offering flexibility and automation.

Understanding Different Budgeting Approaches: Finding Your Perfect Fit

Effective financial management is less about restriction and more about intentionality. When it comes to choosing the right budgeting method, the goal is to find a system that empowers you to make informed decisions about your money. We'll delve into the mechanics, benefits, and challenges of the Envelope System, Zero-Based Budgeting, and the 50/30/20 Rule, providing the insights you need to make an educated choice. Your financial health hinges on understanding where your money goes, and a well-chosen budget illuminates that path.

Deep Dive into the Envelope Budgeting System

The Envelope System is a classic, tangible budgeting method that's been around for decades. It's particularly effective for those who struggle with overspending using credit cards or digital payments. The premise is simple: allocate physical cash into designated envelopes for different spending categories. Once an envelope is empty, spending in that category stops until the next income cycle.

How It Works

- Categorize Expenses: Identify your variable spending categories like groceries, entertainment, dining out, and personal care.

- Withdraw Cash: At the start of your budget period (e.g., bi-weekly or monthly), withdraw your budgeted amount in cash.

- Fill Envelopes: Divide the cash into physical envelopes, labeling each with its corresponding category.

- Spend and Track: Only spend the cash available in each envelope. When it's gone, you're done.

Pros of Envelope Budgeting

- Visual Control: Provides a clear, immediate visual of how much money is left for specific categories.

- Reduced Overspending: The physical limitation of cash inherently prevents overspending in a category.

- Increased Awareness: Promotes mindful spending as you physically hand over money for purchases.

Cons of Envelope Budgeting

- Inconvenience: Carrying large amounts of cash can be risky and impractical in a digital world.

- Limited Online Use: Not suitable for online purchases or automated bill payments.

- Difficulty Tracking: Can be harder to track overall spending trends digitally unless meticulously recorded elsewhere.

Who It's Best For

The Envelope System is ideal for individuals who are new to budgeting, tend to overspend with credit cards, or prefer a tangible, hands-on approach to money management. It's especially effective for managing variable household expenses.

Mastering the Zero-Based Budgeting Method

Zero-Based Budgeting (ZBB) is a powerful strategy where every dollar of your income is assigned a specific "job" at the beginning of each budget period. This means your income minus your expenses (including savings and debt payments) should equal zero. It's an active, intentional approach that ensures no money is unaccounted for.

How It Works

- List All Income: Determine your total net income for the budget period.

- List All Expenses: Categorize all your fixed and variable expenses, including savings goals and debt repayments.

- Allocate Every Dollar: Assign a dollar amount from your income to each expense and savings category until your income minus your allocated funds equals zero.

- Track and Adjust: Throughout the month, track your spending and make adjustments as needed.

Pros of Zero-Based Budgeting

- Maximum Control: Ensures you know exactly where every dollar is going, preventing "leakage."

- Prioritization: Forces you to prioritize spending and savings, aligning with your financial goals.

- Eliminates Waste: Identifies unnecessary spending, making you more efficient with your money.

Cons of Zero-Based Budgeting

- Time-Consuming: Requires diligent setup and regular tracking, especially initially.

- Flexibility Challenges: Can feel restrictive if unexpected expenses arise frequently.

- Learning Curve: Takes commitment to get used to the detailed allocation process.

Who It's Best For

ZBB is excellent for those seeking maximum financial control, serious about debt reduction, or keen on achieving specific savings goals. It's perfect for detail-oriented individuals who are comfortable with consistent monitoring. A 2024 analysis by Financial Wellness Solutions Inc. highlighted that individuals consistently using zero-based budgeting reported a 15% increase in annual savings compared to those with no formal budgeting method.

Simplifying Finances with the 50/30/20 Budget Rule

The 50/30/20 Rule is a straightforward, percentage-based budgeting method that divides your after-tax income into three broad categories: Needs, Wants, and Savings/Debt Repayment. It offers a balance between flexibility and structure, making it a popular choice for many.

How It Works

- Calculate Net Income: Determine your income after taxes and deductions.

- Allocate Percentages:

- 50% to Needs: Essential expenses like housing, utilities, groceries, transportation, and minimum loan payments.

- 30% to Wants: Discretionary spending such as dining out, entertainment, hobbies, and vacations.

- 20% to Savings & Debt: Contributions to savings accounts (emergency fund, retirement), investments, and extra payments on debt.

Pros of the 50/30/20 Rule

- Simplicity: Easy to understand and implement, requiring less granular tracking than ZBB.

- Flexibility: Allows for discretionary spending while still prioritizing essential needs and future goals.

- Promotes Balance: Encourages a healthy mix of current enjoyment and future financial security.

Cons of the 50/30/20 Rule

- Less Granular: Might not provide enough detail for those needing strict control over specific categories.

- Income Dependent: Can be challenging for those with very low or highly variable incomes to fit within the percentages.

- Requires Self-Discipline: Relies on honest categorization of "needs" versus "wants."

Who It's Best For

This method is ideal for individuals seeking a simple, balanced approach to budgeting, particularly those with stable incomes who want a flexible framework without micromanaging every dollar. It's often recommended for beginners who want a clear starting point for choosing the right budgeting method.

Comparing Budgeting Methods: Which One Reigns Supreme?

When it comes to choosing the right budgeting method, there's no single "best" option. The ideal method is highly personal, depending on your financial situation, personality, and specific goals.

- For Absolute Control & Debt Elimination: Zero-Based Budgeting offers unparalleled oversight, making it powerful for aggressive debt paydown or rapid savings accumulation.

- For Curbing Overspending & Visual Learners: The Envelope System is a tangible way to control impulse purchases, especially beneficial for those struggling with credit card debt.

- For Simplicity & Balance: The 50/30/20 Rule provides a sustainable framework that balances current enjoyment with future financial security, suitable for most income levels.

Ultimately, the most effective budget is one you can consistently maintain. A 2023 survey published by the Journal of Consumer Finance indicated that adherence to a budget plan, regardless of the specific method, was the strongest predictor of long-term financial stability.

Differentiating Your Budgeting Journey: Unique Insights and Trends

Beyond the traditional breakdowns, recent trends offer fresh perspectives on budgeting.

- The Rise of Hybrid Budgeting: Many individuals are finding success by blending elements from different methods. For instance, using a 50/30/20 framework for overall allocation, but employing the Envelope System for specific problematic "want" categories (like dining out) or a zero-based approach for specific financial goals. This adaptive strategy acknowledges that financial lives are rarely static and allows for greater personalization.

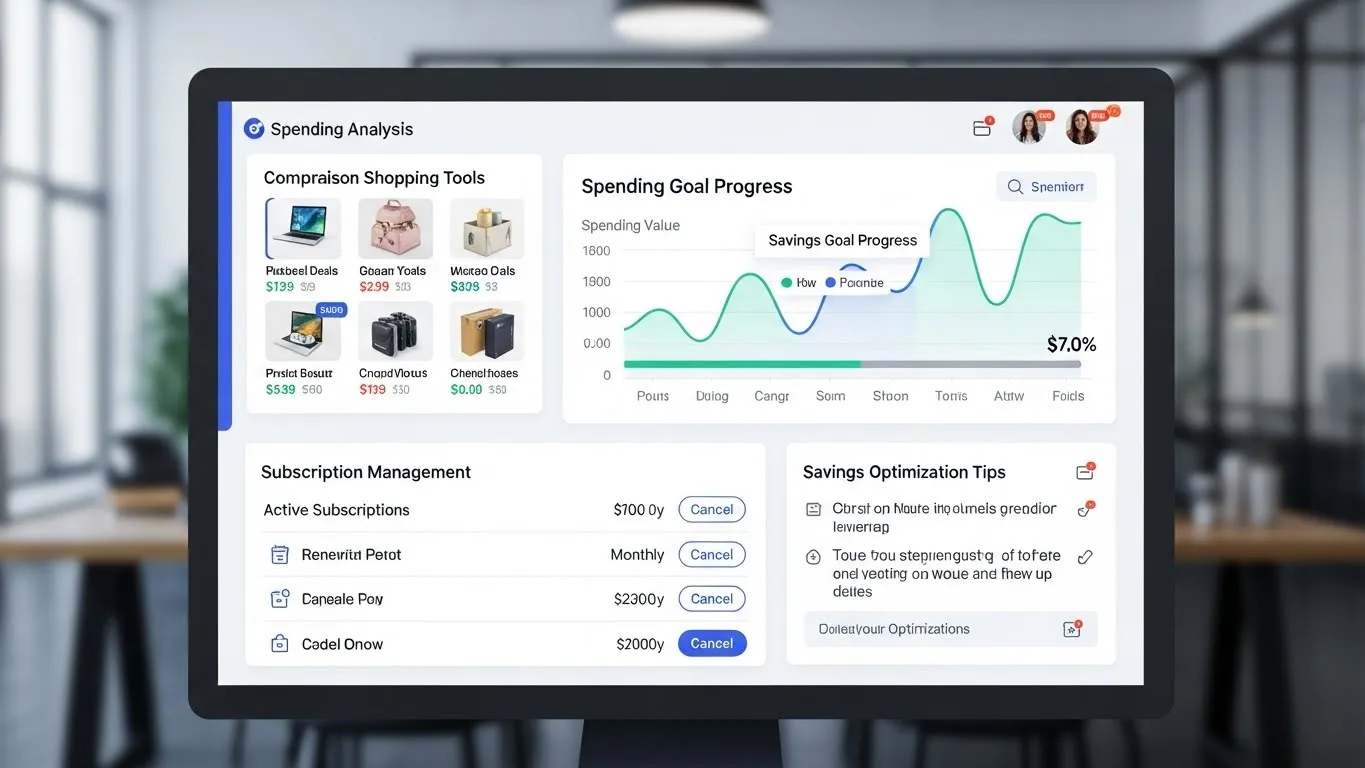

- Behavioral Economics in Budgeting: Modern budgeting increasingly incorporates insights from behavioral economics. Instead of just tracking numbers, focus is placed on understanding why we spend. Digital tools now leverage "nudges" and visualization techniques to help users stick to their budgets. For example, apps might show "how many more coffees" you can afford in a category or gamify savings, making the process less about restriction and more about positive reinforcement and habit formation. This shift helps overcome the psychological barriers to consistent budgeting.

Practical Tips for Implementing Your Chosen Budgeting Method

Once you've decided on choosing the right budgeting method, implementation is key.

- Start Small: Don't try to perfect everything at once. Pick one method and commit for a month.

- Be Patient: It takes time to get used to a new financial routine. Expect to make adjustments.

- Review Regularly: Check your budget at least weekly to ensure you're on track. A quarterly comprehensive review is also beneficial for long-term planning.

- Automate Where Possible: Set up automatic transfers to savings accounts or for bill payments to reinforce your budget.

- Utilize Technology: Numerous budgeting apps and software can simplify tracking, categorizing, and analyzing your spending, regardless of the method you choose.

Frequently Asked Questions (FAQ)

Which budgeting method is best for beginners?

For beginners, the 50/30/20 Rule is often recommended due to its simplicity and balanced approach. It provides a clear framework for allocating income without getting bogged down in minute details. The Envelope System can also be very effective for beginners, especially those needing a tangible way to control spending and visualize their money.

Can I combine different budgeting methods?

Absolutely! Many people find success with a hybrid approach. For example, you might use the 50/30/20 rule for your overall financial framework but then apply Zero-Based Budgeting to specific, high-priority savings goals, or use the Envelope System for discretionary spending categories to prevent overspending. This adaptability is key to long-term success.

How often should I review my budget?

It's advisable to review your budget at least weekly to ensure you're on track and to make minor adjustments. A more comprehensive review should be conducted monthly, especially after your main income influx, to reallocate funds and account for any unexpected expenses. Annually, review your budget against your larger financial goals to see if your strategy needs a major overhaul.

What digital tools support these budgeting methods?

Many modern financial apps support various budgeting methods. For Zero-Based Budgeting, tools like YNAB (You Need A Budget) are popular. For the 50/30/20 Rule or general tracking, apps like Mint, Personal Capital, or Simplifi offer robust categorization and reporting. Even for the Envelope System, digital "envelope" apps exist that simulate the cash experience without the physical cash.

Take Control of Your Finances Today

Choosing the right budgeting method is a significant step toward achieving your financial goals, whether it's paying off debt, building an emergency fund, or saving for a major purchase. Each method—Envelope, Zero-Based, or 50/30/20—offers unique advantages. The key is to select a system that resonates with you and that you can consistently maintain. Don't be afraid to experiment or combine elements until you find your perfect fit.

We encourage you to share your experiences and tips in the comments below! What budgeting method has worked best for you, and why? Your insights can help others on their financial journey.

Further Reading & Next Steps:

- Explore strategies for tracking your daily expenses effectively to complement your budgeting method:

/articles/tracking-your-expenses-effectively - Learn about building a robust emergency fund as a cornerstone of financial security:

/articles/saving-for-major-financial-goals - Discover more essential tips within our comprehensive budgeting and expense tracking category:

/categories/budgeting-and-expense-tracking

Timeliness Note: This article reflects current best practices in personal finance budgeting as of its publication date (December 2025). Financial advice and tools evolve; it's recommended to review your chosen method and related strategies periodically.

Expandable Related Subtopics for Future Updates:

- AI and Predictive Budgeting: Exploring how artificial intelligence is shaping the future of personal finance management.

- Budgeting for Irregular Income: Tailored strategies for freelancers, gig workers, and commission-based earners.

- The Psychology of Saving: Delving into behavioral science to build better financial habits.