Automating Your Savings: Effortless Strategies to Build Wealth and Achieve Financial Goals

The journey to financial security and wealth accumulation often feels like an uphill battle, fraught with complex decisions and the constant pressure to "do more." However, what if you could put your savings on autopilot, transforming your financial landscape with minimal effort? Automating your savings is not just a convenience; it's a powerful strategy that removes human error, boosts consistency, and accelerates your progress toward every financial milestone. This guide delves into actionable, effortless strategies designed to help you build wealth and confidently achieve your financial goals, from emergency funds to retirement, by simply setting up automated systems.

Key Points:

- Automatic Transfers: Set up recurring deposits from checking to savings/investing.

- Direct Deposit Allocation: Split your paycheck to different accounts automatically.

- Micro-Investing Apps: Round up purchases and invest the change effortlessly.

- Debt Repayment Automation: Schedule consistent payments to reduce liabilities faster.

- Regular Reviews: Periodically adjust automation as financial circumstances change.

The Power of Automating Your Savings: Why It Works

Imagine consistently saving without having to think about it. That's the core promise of automation, and it's a game-changer for personal finance. Automating your savings leverages human psychology rather than fighting against it, transforming a often-dreaded task into a seamless background process. This approach is fundamental to long-term financial success.

Overcoming Behavioral Biases with Automation

One of the biggest hurdles to saving is our own behavior. We often fall prey to "present bias," favoring immediate gratification over future rewards. We might also experience decision fatigue, making us less likely to save after a long day. Automation directly counters these tendencies. By setting up automatic transfers, you pre-commit to your financial future. The money moves before you even have a chance to miss it, effectively "paying yourself first" without conscious effort. This strategy dramatically increases your likelihood of adhering to your financial plan.

The Magic of Consistency and Compounding

Consistency is king when it comes to building wealth, and automation ensures a steady stream of contributions. Coupled with the power of compound interest, even small, regular savings can grow into substantial sums over time. Every automated deposit, no matter how modest, becomes a seed that can blossom into significant wealth. A 2024 study by Fidelity Investments highlighted that individuals who consistently automate their savings tend to accumulate 50% more wealth over a decade compared to those who save manually, underscoring the immense value of this disciplined approach.

Getting Started: Essential Steps for Automated Wealth Building

Embarking on your automated savings journey is straightforward. It begins with clarity and choosing the right tools. By taking these initial steps, you lay a solid foundation for achieving your financial goals.

Define Your Financial Goals Clearly

Before you can automate, you need to know what you're saving for. Are you building an emergency fund, saving for a down payment, planning for retirement, or paying off debt? Each goal might require a different account or strategy. Clearly defined goals provide purpose and direction to your automated efforts. For instance, saving for a home might involve a high-yield savings account, while retirement savings would lean towards investment vehicles.

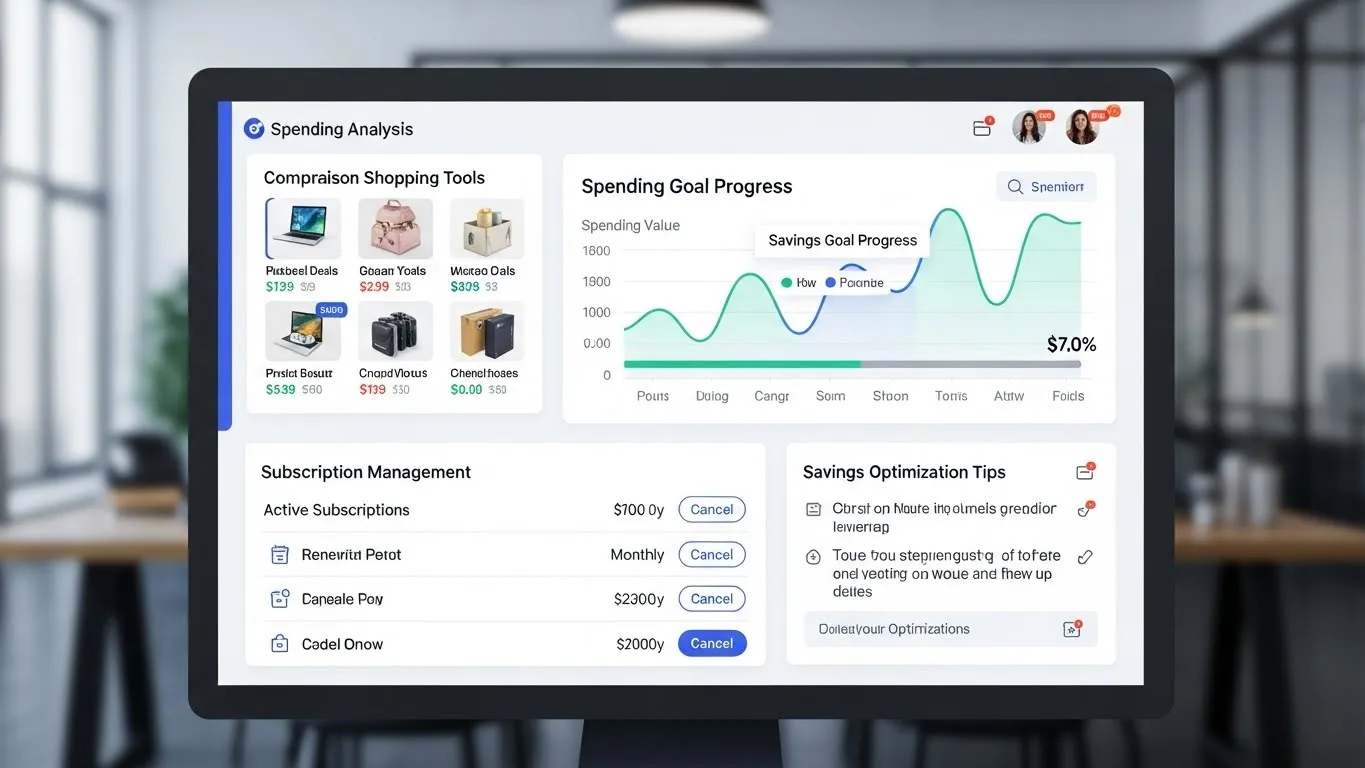

Choose the Right Automation Tools

The modern financial landscape offers an array of tools to facilitate automation. Your bank likely provides free automatic transfer services. Beyond that, consider budgeting apps, micro-investing platforms, and robo-advisors. The "right" tools are those that align with your comfort level, financial goals, and offer the most seamless integration with your existing accounts. Many tools can connect and work together, creating a comprehensive financial automation ecosystem.

Core Strategies for Effortless Savings Automation

Once your goals are set and tools are identified, it's time to implement the core strategies that make automating your savings truly effortless. These methods form the backbone of a successful wealth-building plan.

Set Up Automatic Transfers to Dedicated Accounts

This is the most fundamental step. Instruct your bank to automatically transfer a specific amount from your checking account to a designated savings or investment account on a regular schedule (e.g., weekly, bi-weekly, or monthly). Create separate accounts for different goals, such as an emergency fund, a vacation fund, or a down payment. This separation makes it easy to track progress and avoids accidentally spending money earmarked for a specific purpose. For example, you can begin by setting up a small transfer, like $25 a week, and gradually increase it as your income or budget allows.

Optimize Your Paycheck with Direct Deposit Splits

Many employers offer the option to split your direct deposit across multiple bank accounts. This is an incredibly powerful way to automate your savings before the money even touches your checking account. You can direct a percentage or a fixed amount of each paycheck directly into your savings, investment, or even debt repayment accounts. This effortless strategy ensures that you "pay yourself first" without any manual intervention, making it much harder to overspend.

Leverage Micro-Investing and Round-Up Apps

For those who find it challenging to save larger sums, micro-investing apps offer a gentle introduction to wealth building. Apps like Acorns or Stash round up your debit or credit card purchases to the nearest dollar and invest the difference. These small, consistent contributions accumulate surprisingly quickly, often without you noticing the individual transfers. This method democratizes investing, making it accessible even with spare change.

Automate Debt Repayment and Bill Payments

While primarily focused on savings, automation extends to managing your liabilities, which is equally crucial for building wealth. Set up automatic payments for all your bills, including credit card statements, loan payments, and utilities. This prevents late fees, protects your credit score, and systematically reduces your debt burden. For high-interest debts, consider setting up additional automated payments beyond the minimum to accelerate your path to being debt-free.

Build a Robust Emergency Fund Automatically

An emergency fund is the bedrock of financial security. Automating contributions to this fund ensures you have a safety net for unexpected expenses like job loss or medical emergencies. Start with a modest amount and steadily increase it until you have three to six months' worth of essential living expenses saved. For comprehensive guidance on establishing this crucial buffer, explore our dedicated resources on /categories/emergency-fund-building. Having a strong, foundational emergency fund provides peace of mind and prevents minor setbacks from derailing your financial progress. Research from the Pew Charitable Trusts in 2023 indicated that having an emergency fund is significantly more likely when automatic transfers are in place, reducing financial stress for households.

Advanced Automation Techniques for Building Wealth

Once you've mastered the basics, there are more sophisticated ways to supercharge your automated wealth building. These strategies can help you maximize your returns and solidify your financial future.

Integrating Robo-Advisors for Automated Investing

For those looking to invest but intimidated by the complexities of the stock market, robo-advisors are an excellent solution. Platforms like Betterment or Wealthfront use algorithms to build and manage diversified investment portfolios tailored to your risk tolerance and financial goals. You can set up automatic recurring deposits, and the robo-advisor handles the investing, rebalancing, and tax-loss harvesting for you. This allows you to harness the power of compound interest with minimal effort, making long-term wealth accumulation truly effortless. To learn more about how your investments can grow over time, consider reading our article on /articles/understanding-compound-interest-how-it-fuels-your-wealth.

Automating "Found Money"

Beyond regular paychecks, many people receive sporadic windfalls like tax refunds, bonuses, or gifts. Instead of spending this "found money," automate its allocation. Before you even receive it, decide on a plan: direct a portion to savings, invest another part, and perhaps use a small percentage for discretionary spending. Setting up a system to automatically distribute these extra funds prevents impulse spending and significantly boosts your progress toward your financial goals.

Overcoming Challenges and Maintaining Your Automated System

While automation is powerful, it's not entirely "set it and forget it" forever. Periodic check-ins and adjustments are vital to ensure your system remains aligned with your evolving financial life.

Regular Reviews and Adjustments

Life happens. Your income changes, your expenses shift, and your financial goals may evolve. Schedule a quarterly or semi-annual "financial automation review." During this time, check your accounts, ensure your automated transfers are still appropriate, and adjust amounts as needed. If you get a raise, immediately increase your automated savings to prevent lifestyle creep. If an expense increases, you might temporarily reduce savings to accommodate, but aim to restore it as soon as possible.

Staying Motivated and Celebrating Milestones

Even with automation, staying engaged with your financial journey is important. Track your progress regularly and celebrate milestones. Seeing your savings grow, your debts shrink, or your investments compound can be incredibly motivating. Share your successes with a trusted friend or partner. This positive reinforcement encourages you to maintain and even expand your automated strategies, reinforcing the belief that building wealth is an achievable and rewarding endeavor.

FAQ Section

Q: Is automating savings only for high earners?

A: Absolutely not. Automating savings is beneficial for everyone, regardless of income level. The core principle is consistency and "paying yourself first." Even starting with a small amount, like $5 or $10 a week, can create a significant impact over time thanks to compound interest. The key is to start somewhere and build the habit.

Q: How much should I automate for savings?

A: A common guideline is to save at least 10-20% of your gross income. However, the ideal amount depends on your specific financial goals, income, and expenses. Start with what you can comfortably afford, even if it's less than 10%, and gradually increase it. Aim to prioritize an emergency fund first, then allocate to retirement and other long-term goals.

Q: What if I need access to my automated savings?

A: For short-term goals or emergency funds, choose a high-yield savings account that offers easy access without penalties. For long-term goals like retirement, the money is typically invested and less liquid, which is by design. The purpose of automation is to build discipline; withdrawing frequently defeats the purpose, so ensure you have a separate checking account for everyday spending.

Q: Can I automate debt repayment alongside savings?

A: Yes, and it's highly recommended. Automating minimum payments prevents late fees and protects your credit score. For high-interest debts, you can set up additional automated payments specifically aimed at accelerating repayment. This dual approach of automating both savings and debt reduction is a powerful path to overall financial health and building wealth more quickly.

Conclusion

Automating your savings is arguably the single most effective strategy for building wealth and achieving your financial goals with minimal stress. By leveraging the "set it and forget it" principle, you overcome behavioral challenges, harness the power of consistency and compounding, and steadily progress towards financial independence. From establishing a robust emergency fund to investing for retirement, automation transforms complex financial tasks into effortless routines. Take the initiative today to implement these strategies, start small, stay consistent, and watch your financial future flourish.

Ready to take control of your financial destiny? Start setting up your automated savings plan today! Share your initial steps or success stories in the comments below – your experience could inspire others. For further reading and to deepen your financial knowledge, explore our resources on building a strong /articles/setting-up-your-first-emergency-fund or delving into comprehensive financial planning strategies.